revenue.mt.gov

53

revenue.mt.gov

54

Montana’s individual income tax was enacted in 1933

and is the largest source of state tax revenue. The

state’s income tax has a graduated rate structure with

rates ranging from 1% to 6.9% of taxable income. This

makes it a “progressive” tax because taxpayers with

higher incomes pay a higher percentage of their income

in tax.

Like most of the 43 states with an income tax, Montana

has tied its income tax very closely to the federal income

tax. Montana law denes taxable income largely by ref-

erence to federal denitions of income and deductions,

and Montana income tax returns rely heavily on informa-

tion from federal income tax returns. This reduces the

department’s costs of administering the income tax and

taxpayers’ costs of complying with the income tax.

Montana’s income tax does differ from the federal in-

come tax in several ways, primarily in additions to and

reductions from federal adjusted gross income, unique

itemized deductions, and tax credits. Most of these dif-

ferences reect legislative policy decisions while a few

are due to federal limits on state taxation.

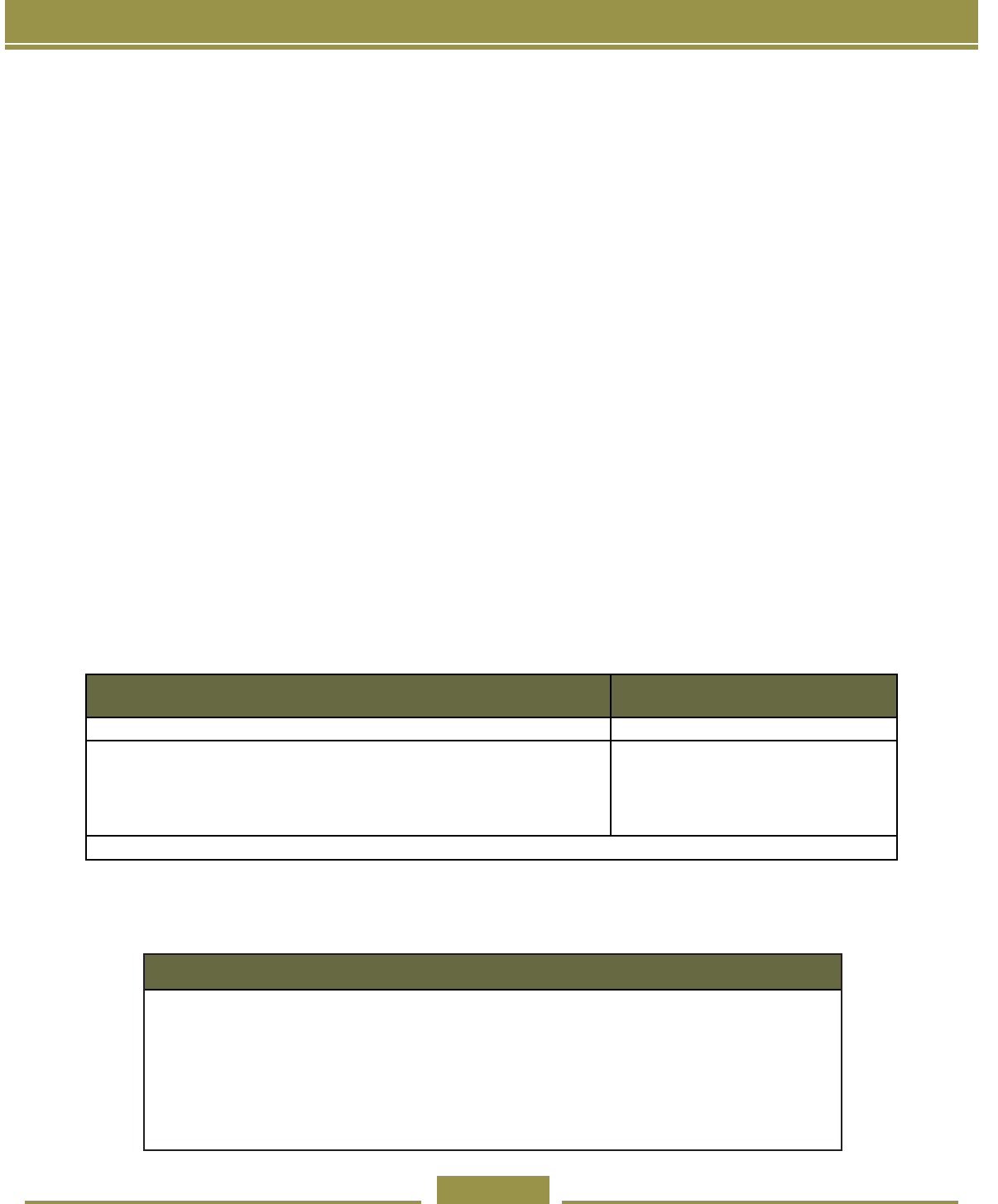

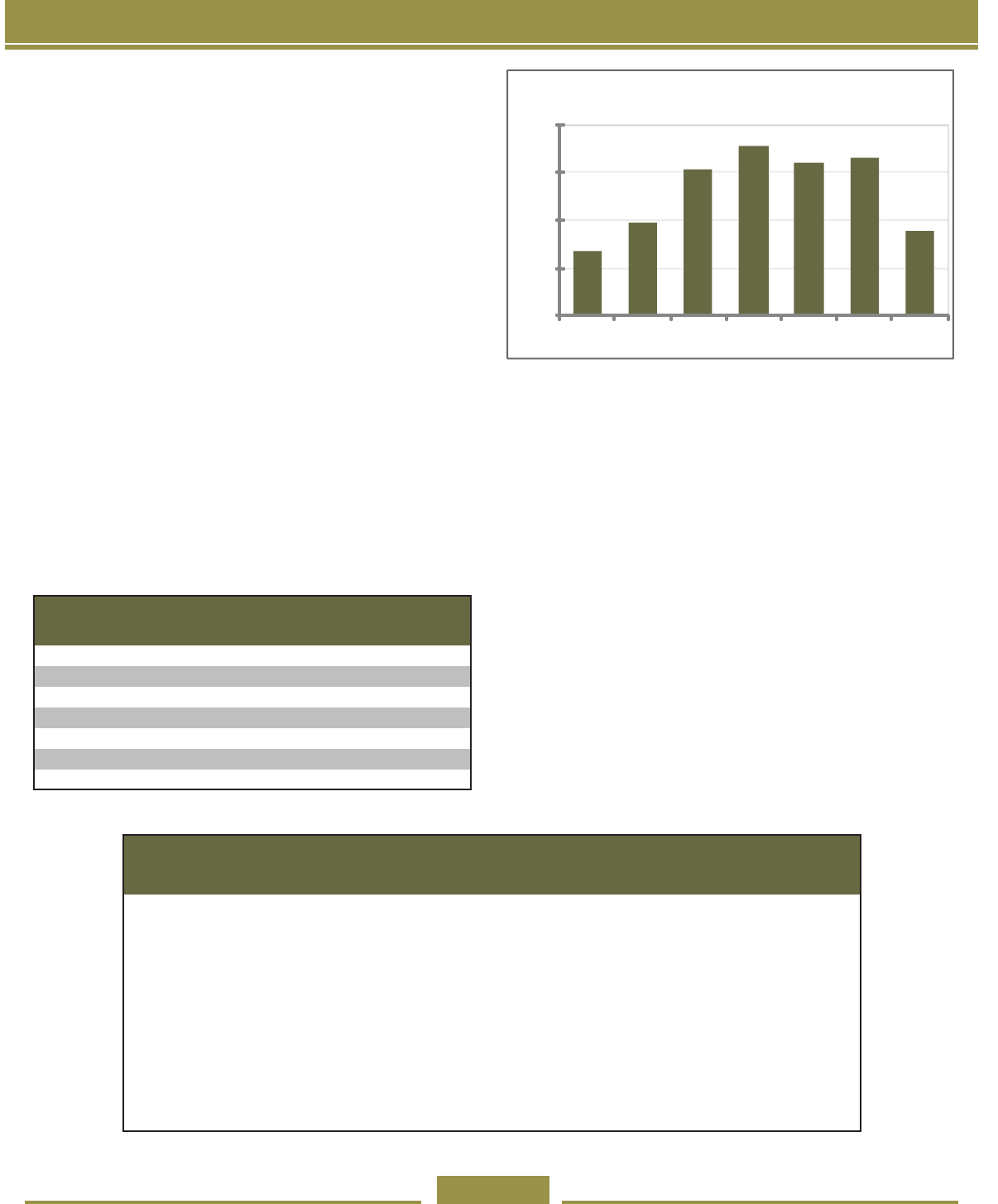

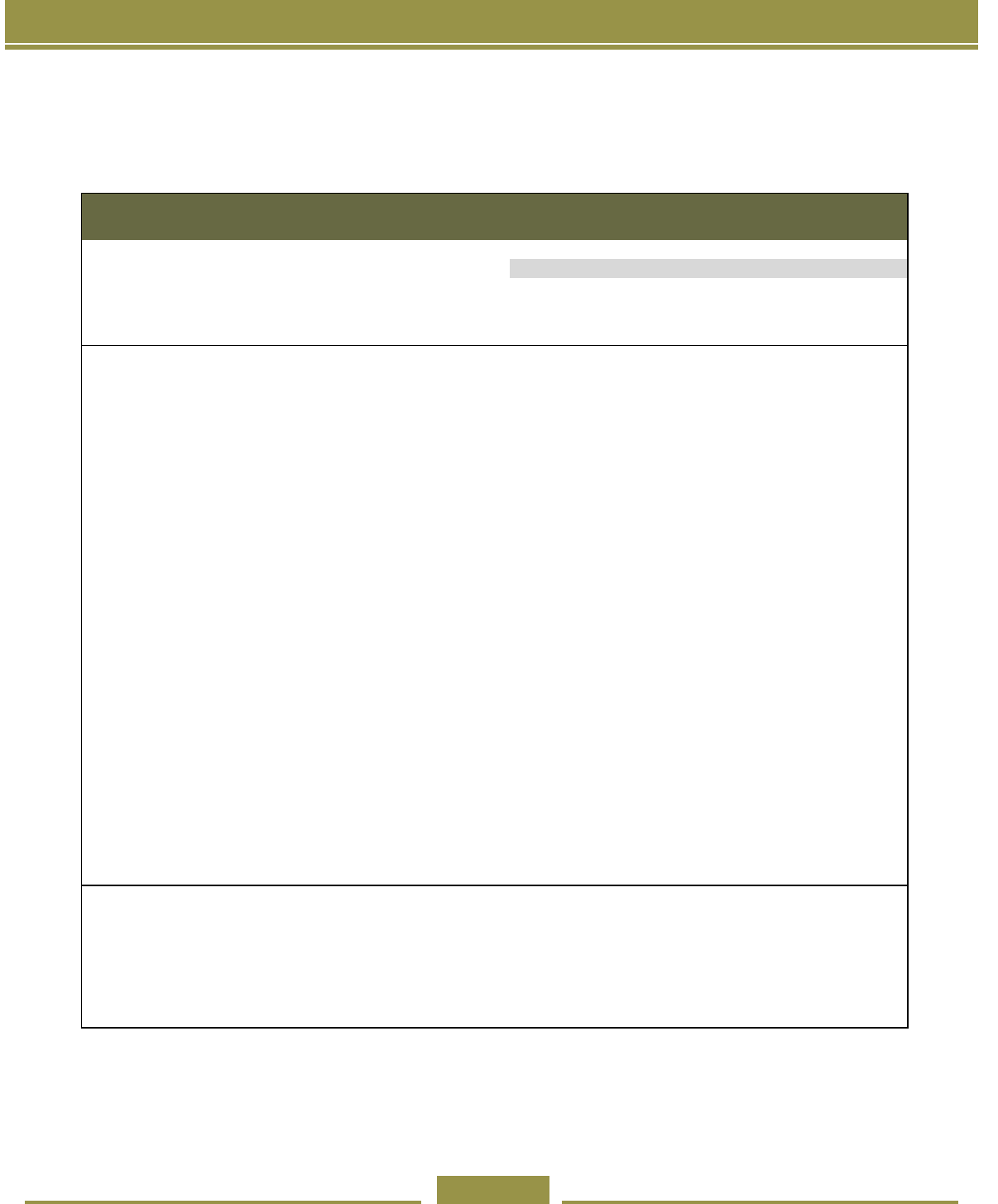

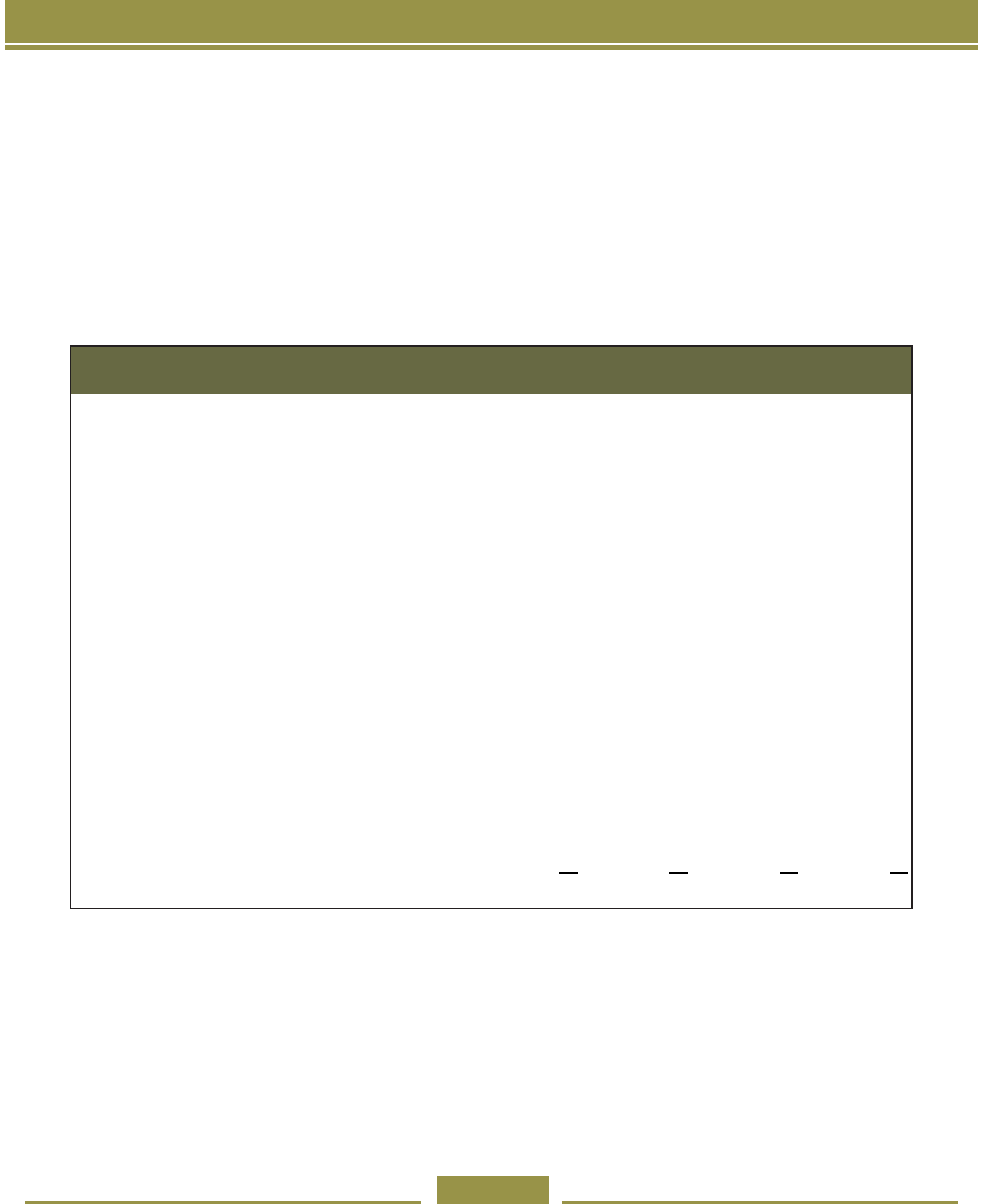

Individual Income Tax Collections

FY2004 $605,348,421

FY2005 $712,280,615

FY2006 $768,911,933

FY2007 $827,095,302

FY2008 $866,638,122

FY2009 $815,138,193

FY2010 $717,834,371

Montana is one of few states that allows a deduction

for federal income taxes, but the deduction is capped

at $5,000 ($10,000 for married couples ling jointly).

Montana also is one of few states that allows married

couples to le separate state returns even if they le a

joint federal return. This reduces household tax liability

and eliminates any “marriage penalty” at the state level.

Since 1981, Montana’s individual income tax – including

the standard deduction, personal exemptions, and tax

rate table brackets – has been adjusted annually for in-

ation. This prevents increases in tax liability that would

otherwise occur due simply to ination.

Income tax revenues are collected primarily through

employer withholding, quarterly estimated tax payments,

and payments made when a return is led. Income tax

revenues are distributed 100% to the state general fund.

605.35

712.28

768.91

827.10

866.64

815.14

717.83

0

100

200

300

400

500

600

700

800

900

1,000

FY2004

FY2005

FY2006

FY2007

FY2008

FY2009

FY2010

Millions

Individual Income Tax Collections

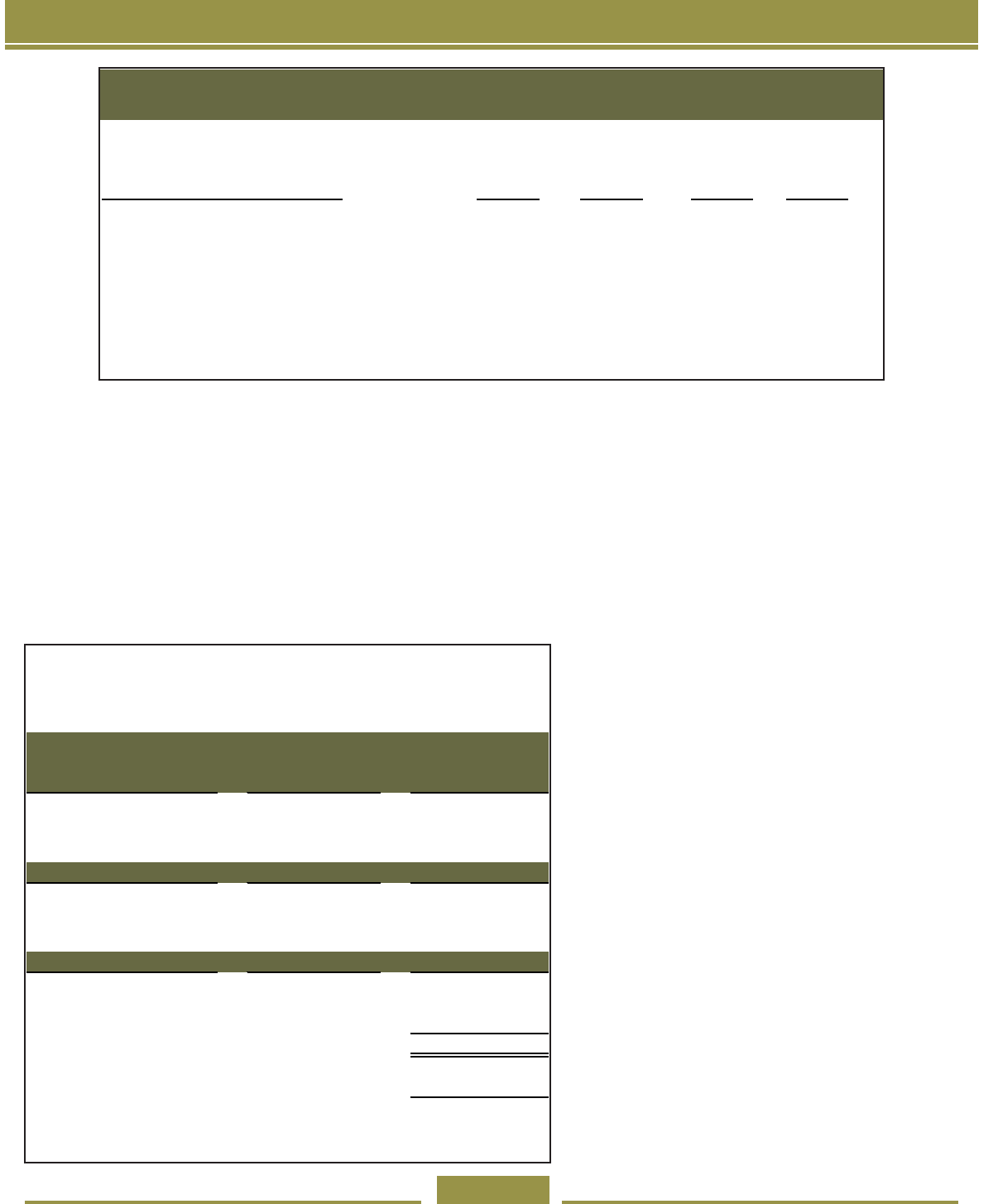

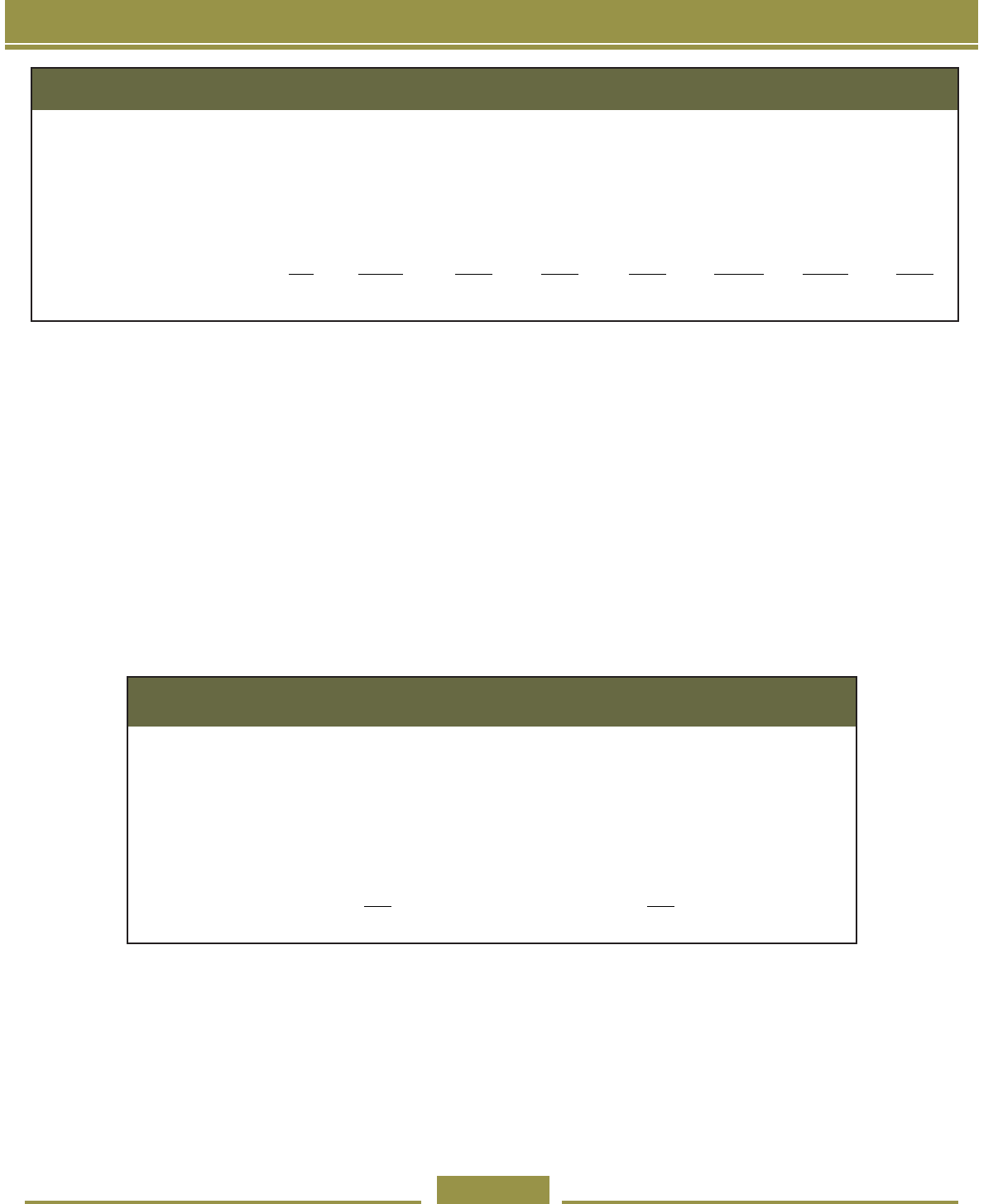

Income Tax Returns and Refunds

Timely Filed Current Year Returns

Calendar

Year

Returns

Returns

with

Refund

Percent

with

Refund

Average

Refund

1999 516,658 254,686 61% $351

2000 529,937 266,152 62% $376

2001 529,955 279,641 65% $413

2002 532,617 287,843 67% $415

2003 536,100 288,154 66% $405

2004 547,623 294,025 66% $468

2005 554,224 297,993 66% $491

2006 572,256 311,789 66% $464

2007 591,874 345,972 71% $506

2008 601,078 345,172 70% $598

2009 587,425 337,714 70% $545

Overview of Individual Income Tax

revenue.mt.gov

55

Recent Legislative Changes to Individual Income Tax

The following bills passed by the 2009 Legislature af-

fected the individual income tax:

House Bill 21 makes permanent the credit for a portion

of the cost of investment in property used to collect or

process reclaimable material and the extra deduction for

10% of a business’s costs of buying recycled material.

Previously, these tax incentives were set to expire at the

end of 2011.

House Bill 163 extended the sunset date for credits for

lm and television production in Montana from the end

of 2009 to the end of 2014.

House Bill 262 made changes to the credit for installing

an alternative energy system in the taxpayer’s principal

residence. It limited the credit to heating systems, and

it made masonry heaters and outdoor hydronic heaters

that meet certain standards eligible for the credit.

House Bill 315 requires that the partial exemption for

pension and annuity income be adjusted for ination

each year beginning in 2010.

House Bill 636 exempts part or all of the gain from sell-

ing a mobile home park to a tenants’ or residents’ as-

sociation, a non-prot that buys the park on behalf of the

residents, or a municipal or county housing authority.

For a park with 50 or fewer lots, the full gain is excluded

from income. For a park with more than 50 lots, half the

gain is excluded.

Senate Bill 135 makes one change to the Insure Mon-

tana credit for small businesses that begin providing

group health insurance for employees. Previously, an

employer was ineligible if any employee who was not a

part-owner was paid wages of more than $75,000 per

year. This bill prevents any part-owner of an eligible

business who is paid wages of more than $75,000 per

year from claiming the credit.

Senate Bill 181 requires proceeds from the sale or ex-

change of real estate to be reported to the Department

of Revenue whenever they are required to be reported

to the IRS on a Form 1099-S.

Senate Bill 260 allows publicly traded partnerships to

le annual information returns showing partners who

received Montana source income in lieu of the normal

requirement for a pass-through entity to either pay tax

on behalf of its owners or le a form showing that the

owners agree to pay tax themselves.

Senate Bill 418 increases the limit on income that a

person can earn and be claimed as another’s dependent

from $800 to the personal exemption amount. It also

allows a taxpayer who the IRS has relieved from liability

for their spouse’s understatement of tax liability to apply

to the department for the same relief.

revenue.mt.gov

56

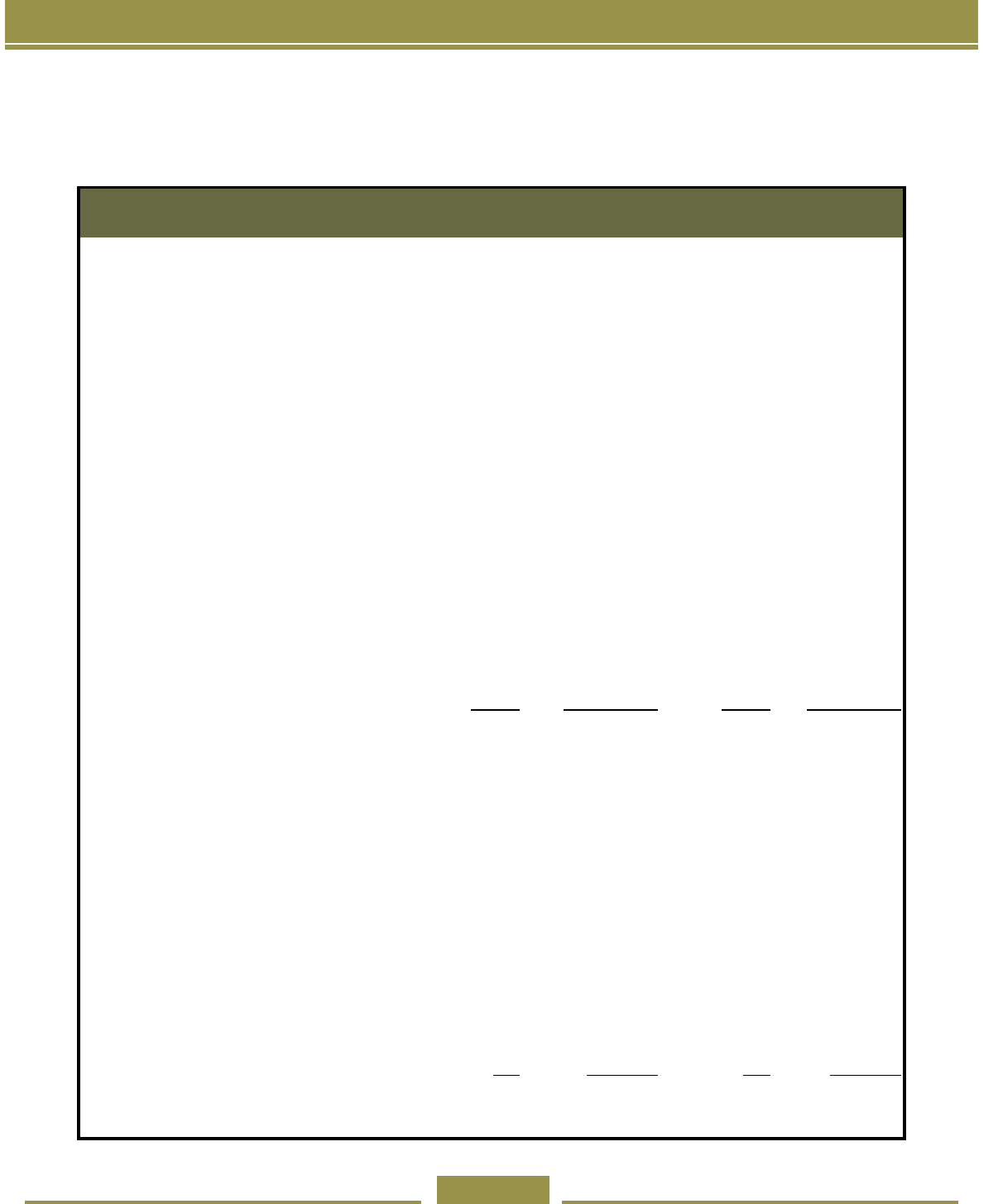

Calculation of Individual Income Tax

Calculation of Montana individual income tax begins with

the taxpayer’s Federal Adjusted Gross Income.

Several adjustments are made to give Montana

Adjusted Gross Income:

• Income taxed by the state but exempted by the

federal government is added,

• Income exempted by the state but taxed by the

federal government is subtracted,

• Deposits to Montana tax-advantaged savings ac-

counts are subtracted,

• Taxable withdrawals from Montana tax-advan-

taged savings accounts are added,

• Net adjustments from ling a joint federal return

and separate state returns are added, and

• Recoveries of costs deducted in previous years

(primarily refunds of federal taxes previously

deducted) are subtracted.

The values of the taxpayer’s exemptions and either

itemized or standard deductions are subtracted to give

Montana Taxable Income. The value of exemptions

and maximum and minimum standard deductions are

adjusted for ination each year:

Tax liability is calculated from the rate table. The rate

table is adjusted for ination each year:

Tax Rate For 2008 Applies to Income Over but Not Over For 2009 Applies to Income Over but Not Over

1.0% $0 $2,600 $0 $2,600

2.0% $2,600 $4,600 $2,600 $4,500

3.0% $4,600 $7,000 $4,500 $6,900

4.0% $7,000 $9,500 $6,900 $9,300

5.0% $9,500 $12,200 $9,300 $12,000

6.0% $12,200 $15,600 $12,000 $15,400

6.9% $15,600 $15,400

Any credits the taxpayer may claim are subtracted from

the tax liability to give the net tax.

• Taxpayers with capital gains income are allowed

a credit equal to 2% of their capital gains. In ef-

fect, this taxes capital gains at a lower rate than

other income.

• Other credits generally are a percentage of a

certain type of qualifying expenditure the tax-

payer has made.

Exemption Amount $2,140 $2,110

Minimum Standard Deduction $1,780 $3,560 $1,750 $3,500

Maximum Standard Deduction $4,010 $8,020 $3,950 $7,900

Standard Deductions: 20% of Montana Adjusted Gross Income with Maximum and Minimum

Single and Separate

Returns

Joint

Returns

Single and Separate

Returns

Joint

Returns

Tax Year 2009Tax Year 2008

revenue.mt.gov

57

Income, Deductions, Credits, and Tax from 2008 and 2009 Returns

The next six tables show information about individual

line items on full year residents’ income tax returns for

2008 and 2009. For each line item, the table shows the

count of the number of returns with a value on that line

and the sum of those values.

2008 2009

Count Total Count Total

Income Items

Wage and salary income 431,012 13,352,105,062 421,862 13,136,979,081

Taxable interest income 274,368 674,052,607 251,993 519,760,266

Exempt interest income* 26,829 181,764,183 26,496 178,610,589

Ordinary dividend income 136,766 592,113,015 125,833 462,423,006

Qualified dividend income * 114,243 432,759,688 n/a n/a

Taxable refunds of state/local income taxes 103,259 101,843,624 100,555 113,741,795

Alimony received 839 12,216,684 832 12,834,607

Business income (Schedule C) 79,241 701,307,208 76,859 648,186,972

Capital gains income 114,334 1,337,809,696 94,436 912,040,530

Supplemental gains income 15,324 56,735,447 14,975 19,035,494

IRA distributions* 34,950 423,809,760 28,815 368,407,244

IRA distributions - Taxable amt 42,487 451,708,587 34,825 396,729,060

Pension and annuity income* 88,865 2,120,658,359 86,664 3,037,304,264

Pension and annuity income - Taxable amt 92,494 1,509,033,462 92,846 1,567,181,125

Rent, royalty, partnership, etc. income 95,986 1,735,147,210 95,190 1,508,400,268

Farm income 19,760 -210,130,661 19,326 -183,602,398

Unemployment compensation 31,654 102,993,388 33,542 174,819,293

Social Security Benefits* 104,002 1,509,624,382 105,371 1,646,131,586

Taxable social security benefits 63,579 527,626,179 63,158 540,620,199

Other income 49,494

-214,412,339 42,531 -326,314,130

Total income 537,508 20,730,149,169 528,318 19,502,835,168

* Indented items either are part of another line or include another line. They are not part of the total.

Federal Adjustments to Income

Educator Expense

11,075 2556940 11,230 2,641,663

Business expenses

588 1,624,564 582 1,447,975

Health Savings Account deduction

5,791 16,792,206 6,421 19,175,503

Moving expenses

3,126 4,722,743 2,587 3,547,466

One-half self-employment tax

61,780 74,863,322 59,832 70,605,043

Self-employed SEP, SIMPLE, and qual. plans

3,191 46,752,467 2,828 42,822,026

Self-employed health insurance deduction

21,303 102,338,278 20,351 98,936,900

Penalty on early withdrawal of savings

3,689 942,627 3,786 705,172

Alimony paid

1,186 13,387,308 1,162 13,843,756

IRA deduction

15,867 56,421,582 14,555 52,303,964

Student loan interest deduction

43,407 32,089,772 44,490 32,806,866

Tuition & fees deduction

14,602 34238086 6,872 15,216,928

Domestic production activities deduction

5,176 28,313,939 4,995 22,914,712

Federal write-ins

352

2,699,970 317 1,767,132

Total adjustments to income

142,736 417,743,804 136,576 378,735,106

Federal Adjusted Gross Income

537,530 20,312,405,365 528,328 19,124,100,062

Montana Individual Income Tax Income Reported on Full Year

Residents' Returns 2008 and 2009

-

revenue.mt.gov

58

2008 2009

Count Total Count Total

Montana Additions to Federal Adjusted Gross Income

Interest on other states' municipal bonds 17,321 94,380,505 17,681 92,212,666

Dividends not included in FAGI 155 221,776 441 702,870

Taxable federal refunds 90,034 122,652,586 83,066 122,976,647

Recoveries of amounts deducted in earlier years 833 468,721 285 973,921

Additions to federal taxable social security or railroad retirement 6,133 9,379,800 6,722 10,706,356

Allocation of compensation to spouse 611 9,563,306 482 7,202,972

Medical savings account nonqualified withdrawals 109 145,198 113 129,357

First-time homebuyer's account nonqualified withdrawals 8 35,384 14 29,691

Farm and ranch risk management account taxable distributions 1 200 1 697

Dependent care assistance credit adjustment 52 86,959 67 127,529

Smaller federal estate and trust taxable distributions 39 48,095 70 115,517

Federal net operating loss carryover 3,592 190,896,793 4,128 256,422,918

Federal taxes paid by your S. corporation 15 326,001 42 74,002

Title plant depreciation 0 0 2 3,548

Group health premiums reimbursed by Insure Montana credit 769 4,642,233 919 5,094,962

Other additions 7,371

99,710,548 4,922 113,864,663

Total Montana Additions 117,840 532,558,105 109,059 610,638,316

Montana Individual Income Tax Income Reported on Full Year Residents' Returns 2008 and 2009

Income, Deductions, Credits, and Tax from 2008 and 2009 Returns

2008 2009

Count Total Count Total

Montana Subtractions from Federal Adjusted Gross Income

Federal bonds exempt interest

28,534 51,862,384 23,963 37,421,242

Exempt tribal income

7,409 187,639,734 7,735 201,760,096

Exempt unemployment compensation

30,268 99,748,626 32,500 169,813,215

Exempt worker's comp benefits

77 400,335 204 1,006,241

Capital gains from small business investment companies

49 50,125 50 73,145

State tax refunds included in federal AGI

109,494 105,479,553 106,869 118,187,520

Recoveries of amounts deducted in earlier years

37 67,983 22 102,536

Exempt active duty military salary

4,142 131,691,515 4,297 142,046,880

Nonresident exempt military income

112 3,661,691 99 3,560,669

Exempt life insurance premiums reimbursement (National Guard)

126 447,340 41 441,796

Exempt pension income

42,005 134,023,768 41,280 132,876,584

Elderly interest exclusion

72,327 46,871,599 70,449 43,632,908

Exempt retirement disability income (under age 65)

91 369,876 155 656,765

Exempt tip income

11,142 31,562,631 13,348 38,921,676

Exempt income of child taxed to parent

145 251,424 44 99,782

Exempt health insurance premiums taxed to employee

283 1,127,728 160 644,902

Student loan repayments taxed to health care professional

102 294,799 134 370,976

Medical care savings account exempt deposits

7,524 16,967,593 7,425 17,483,938

First-time homebuyer exempt savings account deposits

196 538,398 254 710,124

Family education savings account exempt deposits

2,913 6,854,175 2,741 6,592,192

Farm and ranch risk management accounts exempt deposits

0 0 0 0

Subtraction to federal taxable social security/Tier 1 railroad retirement

31,901 104,252,490 32,847 113,084,380

Subtraction for federal taxable Tier II railroad retirement

3,054 35,527,084 3,025 36,473,121

Subtraction for spouse filing joint return: passive loss carryover

713 4,913,234 76 244,075

Subtraction for spouse filing joint return: capital loss adjustment

1,828 1,918,568 2,481 3,554,062

Allocation of compensation to spouse

611 9,564,024 502 7,418,488

Montana net operating loss carryover

3,397 177,036,342 3,867 242,163,391

40% capital gain exclusion on pre-1987 installment sales

626 2,813,975 250 1,124,567

Business expense of recycled material

72 179,028 115 136,675

Sales of land to beginning farmers

1 2,270 2 7,785

Larger federal estate and trust taxable distributions

153 311,890 110 264,183

Wage deduction reduced by federal targeted jobs credit

58 199,915 63 276,616

Certain gains recognized by liquidating corporation

13 399,697 5 29,686

Other subtractions

4,373

108,699,708 4,154 126,816,297

Total Montana Subtractions

246,009 1,265,729,502 243,960 1,447,996,513

Montana Individual Income Tax Income Reported on Full Year Residents' Returns 2008 and 2009

-

-

revenue.mt.gov

59

2008 2009

Count Total Count Total

Deductions

Total medical expenses* 134,614 550,903,057 133,123 543,571,282

Deductible medical expenses 71,687 309,033,065 73,337 307,848,323

Medical insurance premiums not deducted elsewhere 102,280 328,606,170 103,054 345,055,072

Long-term care insurance premiums 13,640 26,552,393 13,264 26,195,277

Federal Income Tax

Federal income tax withheld* 249,756 1,439,217,079 250,431 1,325,630,593

Federal income tax estimated payments* 55,434 761,008,071 50,339 573,787,410

Last year's federal income tax paid (e.g. with return)* 68,313 360,705,773 52,432 280,037,049

Federal income tax from previous years* 5,147 22,571,910 4,094 36,809,791

Federal economic stimulus rebate 256,154 543,735,650 n/a n/a

Total federal income tax deduction (after $5,000 cap) 262,564 977,041,035 280,813 1,007,165,809

State or Local Sales Tax** n/a n/a 577 621,978

Local income taxes 132 104,485 228 208,407

Real estate taxes 209,253 375,863,167 211,054 390,523,795

Personal property taxes 169,593 54,112,119 164,852 53,773,266

Other deductible taxes 22,848 8,494,096 26,256 8,631,187

Home mortgage interest 161,357 1,151,150,074 160,899 1,114,955,415

Unreported home mortgage interest 5,940 18,043,825 6,296 17,628,247

Unreported points 18,254 5,619,416 22,619 7,701,339

Qualified mortage insurance premiums 11,577 12,656,499 17,371 21,264,234

Investment interest 9,061 49,397,642 8,395 31,368,971

Contributions by cash or check 171,569 434,698,282 169,596 424,565,892

Contributions other than cash or check 70,403 61,442,501 70,044 59,713,638

Carryover of contributions from previous years 2,567 34,852,686 2,750 26,683,941

Child and dependent care expenses 769 1,382,178 889 1,600,514

Casualty and theft losses 393 5,565,994 341 6,906,415

Business Expenses

Unreimbursed employee business expenses* 57,683 187,311,818 56,602 169,613,660

Other business expenses* 142,412 113,984,827 142,920 102,707,081

Total business expenses* 160,914 301,296,645 161,528 272,320,741

Net deductible unreimbursed business expenses 56,879 213,814,844 57,450 191,103,224

Political contributions 11,307 1,062,633 7,052 643,598

All other miscellaneous deductions not subject to 2% floor 2,396 7,969,789 2,175 17,170,824

Gambling losses 1,250

10,936,343 1,169 10,915,626

Total itemized deductions 304,346 4,088,399,236 308,304 4,072,251,370

Unallowed itemized deductions (due to income over threshold) 22,128

23,169,551 18,039 19,210,187

Allowable itemized deductions 304,346 4,065,229,685 308,304 4,053,041,183

Standard deductions 210,558

749,417,878 200,130 697,489,190

Total deductions 531,358 4,814,647,563 523,618 4,750,530,373

* Indented items either are part of another line or include another line. They are not part of the total.

**For 2008, deductible sales tax was reported on the income tax line. It was given its own line for 2009.

Montana Individual Income Tax Deductions Reported on Full Year Residents' Returns 2008 and 2009

Income, Deductions, Credits, and Tax from 2008 and 2009 Returns

-

revenue.mt.gov

60

Income, Deductions, Credits, and Tax from 2008 and 2009 Returns

2008 2009

Count Total Count Total

Exemptions *

Self Exemption

n/a 488987

Self 65 and Over Exemption

n/a 87211

Self Blind Exemption

n/a 1270

Total Taxpayer Exemptions

493,793 582,020 488,992 577,468

Spouse Exemption

n/a 77,278

Spouse 65 and Over Exemption

n/a 31,804

Spouse Blind Exemption

n/a 360

Total Spouse Exemptions

83,285 103,539 87,637 109,442

Dependent Exemptions

132,201 233,053

132,230 234,714

Total Exemptions

493,794 918,613 488,992 921,624

Value of Exemptions

538,660 $2,065,590,060 529,582 $2,033,750,930

Taxable Income

Federal Adjusted Gross Income 537,530 $20,312,405,365 528,328 $19,124,100,062

+Montana Additions 117,840 $532,558,105 109,059 $610,638,316

-Montana Subtractions 246,009 $1,265,729,502 243,960 $1,447,996,513

-Deductions 531,358 $4,814,647,563 523,618 $4,750,530,373

-Value of Exemptions 538,660

$2,065,590,060 529,582 $2,033,750,930

Montana Taxable Income 444,818 $13,848,799,301 430,879 $12,823,448,468

Tax from Tax Table 444,077 $767,801,378 430,142 $705,718,484

Capital Gains Credit 51,631 $26,151,925 30,696 $17,974,296

Tax before Credits & Adjustments 440,443 $741,649,453 427,615 $687,744,188

Tax on Lump Sum Distributions 49 $17,166 39 $6,437

Recapture of Credits Claimed Previously 21 $22,472

25 $38,872

Total Tax $741,689,091 $687,789,497

Payments

Montana income tax withheld from wages

423,083 $602,973,245 413,663 $594,092,298

Tax withheld from mineral royalties

2,474 $6,173,658 2,656 $2,676,680

Tax withheld by pass-through entities

n/a n/a 100 $98,744

Estimated tax payments

50,898 $202,271,498 47,153 $156,234,826

Extension payments

4,421 $20,857,241 3,707 $25,498,836

Total Payments

$832,275,642 $778,601,384

Montana Individual Income Tax Exemptions, Taxable Income, Tax, and Payments Reported on Full

Year Residents's Returns 2008 and 2009

* Taxpayers claim exemptions for themselves and their spouses by checking boxes on the return. The counts for

exemptions show the number of returns where the taxpayer claimed at least one exemption for themself, their spouse,

or dependents. The totals column shows the number and type of exemptions claimed. For the taxpayer and spouse,

the totals column shows the numbers of basic exemptions and extra exemptions for being 65 or over or blind. For

2008, only the total number of taxpayer and spouse exemptions was recorded. For dependent exemptions, the count

is the number of returns claiming at least one dependent, and the total is the number of dependents claimed.

revenue.mt.gov

61

Income, Deductions, Credits, and Tax from 2008 and 2009 Returns

Montana Individual Income Tax Credits Reported on Full Year Residents' Returns 2008 and 2009

2008 2009

Count Total Count Total

Credits

Non-Refundable and No Carryover

Other states' income tax credit 10,735 20,931,634 9,765 16,975,208

College contribution tax credit 2,767 225,228 2,820 237,180

Qualified endowment tax credit 617 1,919,025 579 1,746,260

Energy conservation tax credit 23,656 7,853,727 28,594 9,998,955

Alternative fuel tax credit 45 27,402 55 38,175

Rural physician's tax credit 35 160,294 20 90,312

Insurance for uninsured Montanans credit

493 413,966 377 294,402

Elderly care tax credit 46 48,026 42 45,059

Recycling tax credit 77 527,908 85 439,254

Oil seed crushing/biodiesel facility credit <10 4,047 0 0

Biodiesel blending/storage tank credit <10 1,090 <10 2,630

Non-Refundable but with Carryover

Contractor's gross receipts tax credit 463 1,738,387 510 2,676,113

Geothermal systems tax credit 156 215,157 302 525,153

Alternative energy systems credit 1,804 997,615 2,321 1,302,796

Alternative energy production tax credit <10 8,315 15 33,086

Dependent care assistance credit <10 24,116 <10 7,769

Historic property preservation tax credit 18 60,116 23 134,543

Infrastructure user fee credit 16 30,372 12 27,699

Empowerment zone credit 0 0 0 0

Research activities tax credit 12 391,790 17 345,813

Mineral exploration tax credit <10 44,530 <10 7,749

Film production employment tax credit 0 0 0 0

Adoption credit 205 186,069 194 165,300

Total Non-Refundable Credits 39,108 35,808,814 43,357 35,093,456

Refundable Credits

Elderly homeowner/renter tax credit* 16,698 8,252,383 17,053 8,465,090

Film production employment tax credit 0 0 0 0

Film qualified expenditure tax credit <10 29,230 <10 19,047

Insure Montana small business health

insurance credit

792 2,380,374 911 2,513,344

Emergency lodging credit <10 396 0 0

Total Refundable Credits 13,806 8,901,758 14,497 9,311,534

Total Credits 69,252 66,387,531 75,430 63,883,305

* Credits claimed on tax returns. See the Property Tax section for credits claimed with no income tax return.

-

revenue.mt.gov

62

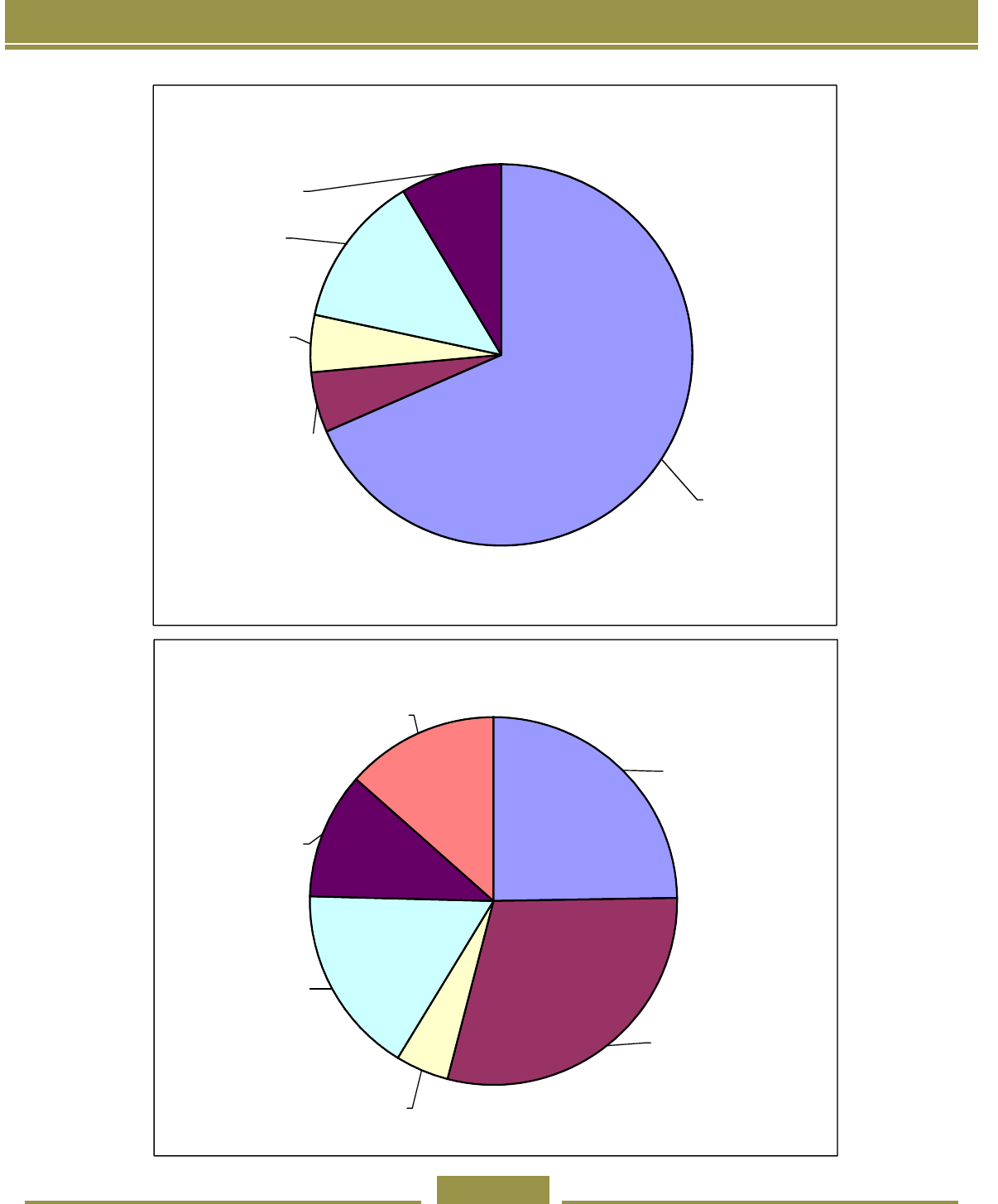

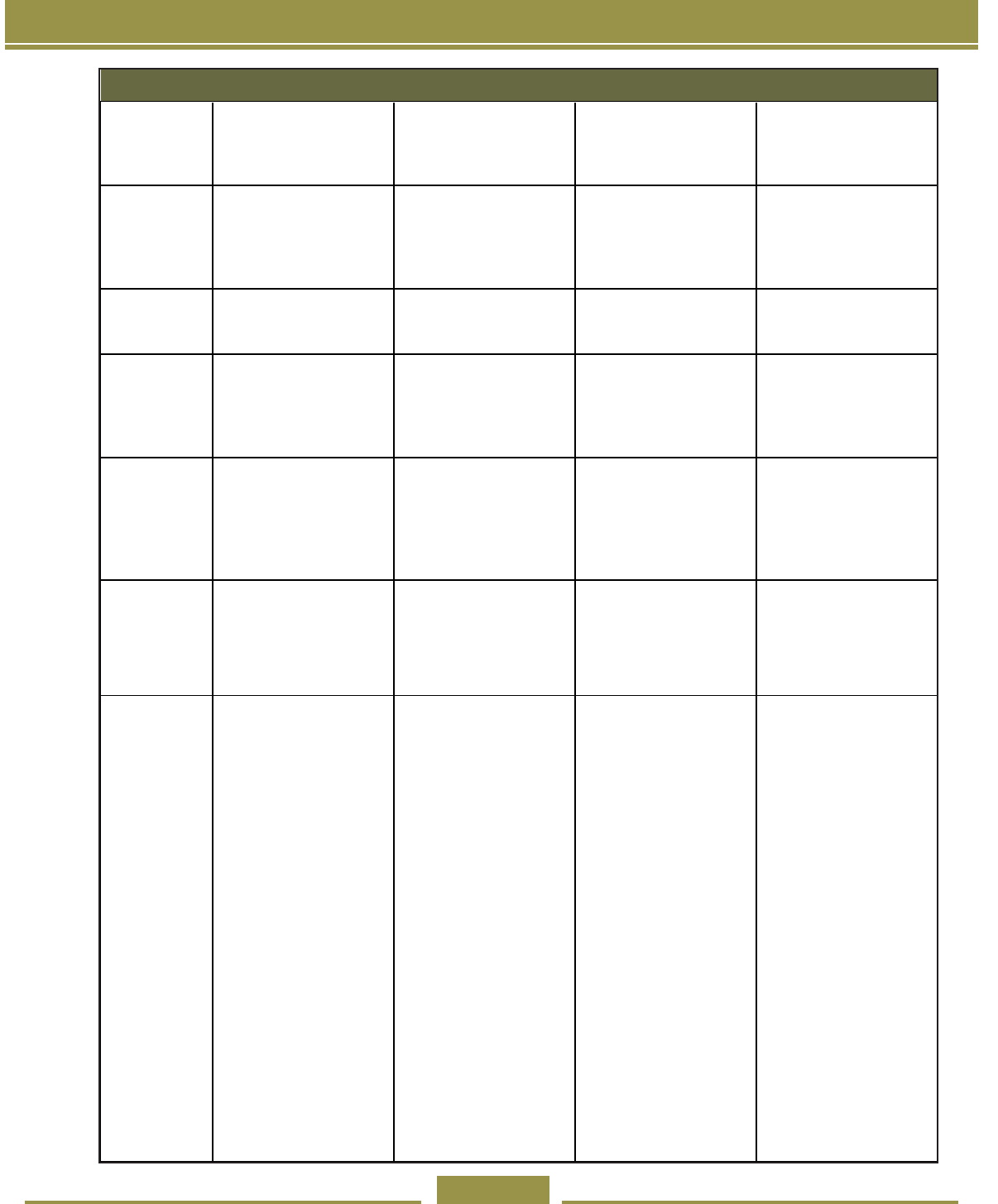

Federal Taxes

25%

Home Mortgage

Interest and Other

Interest

29%

Unreimbursed Business

Expenses

5%

Medical Expenses

17%

Property and Other

Taxes

11%

Contributions and Other

13%

Breakdown of Itemized Deductions - Tax Year 2009

Wages, Salaries, Tips

68%

Interest and Dividend

Income

5%

Capital Gain or Loss

and Supplemental

Gain or Loss

5%

Taxable Social

Security, IRAs,

Pensions, and

Annuities

12%

Business Income

(NBI; Rents,

Royalties,

Partnership: Farm;

Other)

9%

Breakdown of Income Sources - Tax Year 2009

Income, Deductions, Credits, and Tax from 2008 and 2009 Returns

revenue.mt.gov

63

The following tables show Montana adjusted gross

income, deductions, taxable income and tax liability by

decile group. Each decile group is 10% of the popula-

tion of returns, sorted by adjusted gross income. Group

1 is the 10% with the lowest incomes, while group 10

is the 10% with the highest incomes. In these tables, a

married couple who les separate returns on the same

form are counted as two returns, and their income and

tax is counted separately.

Decile

Group

Returns Income Range Returns Income Range

$ million % of total $ million % of total

1 53,870 less than $3,515 -$459.1 -2% 52,962 less than $3,147 -$582.2 -3%

2 53,870 $3,515 to $8,227 $316.0 2% 52,963 $3,147 to $7,822 $290.9 2%

3 53,870 $8,228 to $13,260 $577.3 3% 52,962 $7,823 to $12,724 $542.3 3%

4 53,870 $13,261 to $18,507 $854.5 4% 52,963 $12,725 to $17,963 $810.7 4%

5 53,870 $18,508 to $24,164 $1,146.3 6% 52,963 $17,964 to $23,599 $1,098.0 6%

6 53,870 $24,165 to $31,036 $1,479.8 8% 52,962 $23,600 to $30,408 $1,422.0 8%

7 53,870 $31,037 to $39,139 $1,882.6 10% 52,963 $30,409 to $38,529 $1,818.9 10%

8 53,870 $39,140 to $49,821 $2,378.5 12% 52,962 $38,530 to $49,303 $2,308.6 13%

9 53,870 $49,822 to $69,389 $3,130.9 16% 52,963 $49,304 to $68,155 $3,042.3 17%

10 53,870 more than $69,389 $8,272.2 42% 52,963 more than $68,155 $7,535.3 41%

All 538,700 $19,579.2 529,626 $18,286.7

Montana Adjusted

Gross Income

Montana Adjusted

Gross Income

Deciles of Montana Adjusted Gross Income Full Year Residents 2008 and 2009

2008 2009

Decile

Group

% Returns

Itemize

% Returns

Itemize

$ million average $ million average $ million average $ million average

1 28% $135.1 $8,837 $84.0 $2,177 34% $157.1 $8,831 $76.6 $2,177

2 26% $85.8 $6,026 $81.6 $2,060 28% $93.4 $6,332 $77.7 $2,032

3 37% $142.0 $7,064 $83.9 $2,483 38% $138.5 $6,880 $79.0 $2,406

4 43% $177.4 $7,694 $100.6 $3,263 44% $183.0 $7,863 $94.2 $3,172

5 46% $198.1 $8,030 $117.9 $4,037 47% $208.8 $8,345 $110.5 $3,954

6 56% $264.3 $8,832 $105.5 $4,405 57% $267.0 $8,884 $99.6 $4,348

7 71% $400.5 $10,475 $79.7 $5,099 72% $403.6 $10,525 $73.7 $5,041

8 84% $568.1 $12,541 $51.8 $6,044 85% $561.3 $12,476 $48.2 $6,049

9 91% $749.8 $15,355 $32.6 $6,478 92% $737.2 $15,175 $27.9 $6,372

10 97% $1,344.2 $25,840 $11.8 $6,402 97% $1,303.3 $25,373 $10.1 $6,338

All 58% $4,065.2 $11,607 $749.4 $3,301 59% $4,053.0 $11,598 $697.5 $3,239

Itemized Deductions

Standard Deductions

Deductions by Decile Group Full Year Residents 2008 and 2009

2008 2009

Itemized Deductions

Standard Deductions

Income, Deductions, Credits, and Tax from 2008 and 2009 Returns

revenue.mt.gov

64

Decile

Group

Itemized

Deductions

Standard

Deductions All

Itemized

Deductions

Standard

Deductions All

1 -37% -93% -48% -33% -70% -40%

2 99% 36% 53% 112% 37% 59%

3 65% 23% 39% 67% 24% 40%

4 48% 21% 33% 51% 21% 34%

5 38% 19% 28% 40% 19% 29%

6 32% 16% 25% 33% 16% 26%

7 30% 15% 26% 31% 15% 26%

8 28% 14% 26% 29% 14% 26%

9 26% 11% 25% 26% 11% 25%

10 17% 6% 16% 18% 6% 17%

All 26% 20% 25% 27% 21% 26%

Deductions as % of Montana Adjusted Gross Income Full Year Residents 2008 and 2009

2008 2009

Decile

Group

$ million Average % of Total $ million Average % of Total $ million Average % of Total $ million Average % of Total

1 $0.4 $7 0% $0.0 $0 0% $0.2 $3 0% $0.0 $0 0%

2 $72.2 $1,340 1% $0.8 $16 0% $59.6 $1,125 0% $0.7 $13 0%

3 $231.3 $4,293 2% $4.3 $79 1% $210.3 $3,971 2% $3.8 $72 1%

4 $421.6 $7,827 3% $11.0 $204 1% $387.2 $7,310 3% $9.9 $187 1%

5 $656.4 $12,184 5% $22.4 $416 3% $610.8 $11,533 5% $20.6 $388 3%

6 $929.6 $17,256 7% $39.0 $723 5% $877.4 $16,567 7% $36.4 $687 5%

7 $1,206.9 $22,404 9% $57.3 $1,063 7% $1,151.5 $21,742 9% $54.4 $1,027 8%

8 $1,552.1 $28,811 11% $80.7 $1,498 11% $1,495.6 $28,239 12% $77.6 $1,465 11%

9 $2,119.9 $39,352 15% $119.6 $2,221 16% $2,057.0 $38,839 16% $116.1 $2,192 16%

10 $6,658.5 $123,602 48% $432.7 $8,032 56% $5,973.9 $112,793 47% $386.3 $7,293 55%

All $13,848.8 $25,708 $767.8 $1,425 $12,823.4 $24,212 $705.7 $1,332

Taxable Income and Tax Full Year Residents 2008 and 2009

2008 2009

Taxable Income Tax Liability Taxable Income Tax Liability

Decile

Group

Montana Adjusted

Gross Income

Tax

Liability

Tax /

Income

Montana Adjusted

Gross Income

Tax

Liability

Tax /

Income

$ million $ million % $ million $ million %

1 -$459.1 $0.0 0.0% -$582.2 $0.0 0.0%

2 $316.0 $0.8 0.3% $290.9 $0.7 0.2%

3 $577.3 $4.3 0.7% $542.3 $3.8 0.7%

4 $854.5 $11.0 1.3% $810.7 $9.9 1.2%

5 $1,146.3 $22.4 2.0% $1,098.0 $20.6 1.9%

6 $1,479.8 $39.0 2.6% $1,422.0 $36.4 2.6%

7 $1,882.6 $57.3 3.0% $1,818.9 $54.4 3.0%

8 $2,378.5 $80.7 3.4% $2,308.6 $77.6 3.4%

9 $3,130.9 $119.6 3.8% $3,042.3 $116.1 3.8%

10 $8,272.2 $432.7 5.2% $7,535.3 $386.3 5.1%

All $19,579.2 $767.8 3.9% $18,286.7 $705.7 3.9%

Tax As % of Adjusted Gross Income Full Year Residents 2008 and 2009

2008 2009

Income, Deductions, Credits, and Tax from 2008 and 2009 Returns

revenue.mt.gov

65

Overview of Corporate License Tax

Montana’s corporate license tax is a franchise tax levied

on C corporations for the “privilege of carrying on busi-

ness in this state” (15-31-101(3), MCA). A corporation

includes

an association, joint-stock company, common-law

trust or business trust that does business in an

organized capacity, all other corporations whether

created, organized, or existing under and pursu-

ant to the laws, agreements, or declarations of

trust of any state, country or the United States,

and any limited liability company, limited liabil-

ity partnership, partnership or other entity that is

treated as an association for federal income tax

purposes and that is not a disregarded entity (15-

31-101(1), MCA).

Every bank organized under the laws of Montana or an-

other state or under the United States and every savings

and loan organized under state law or United States law

is also subject to corporate license tax (15-31-101(4),

MCA).

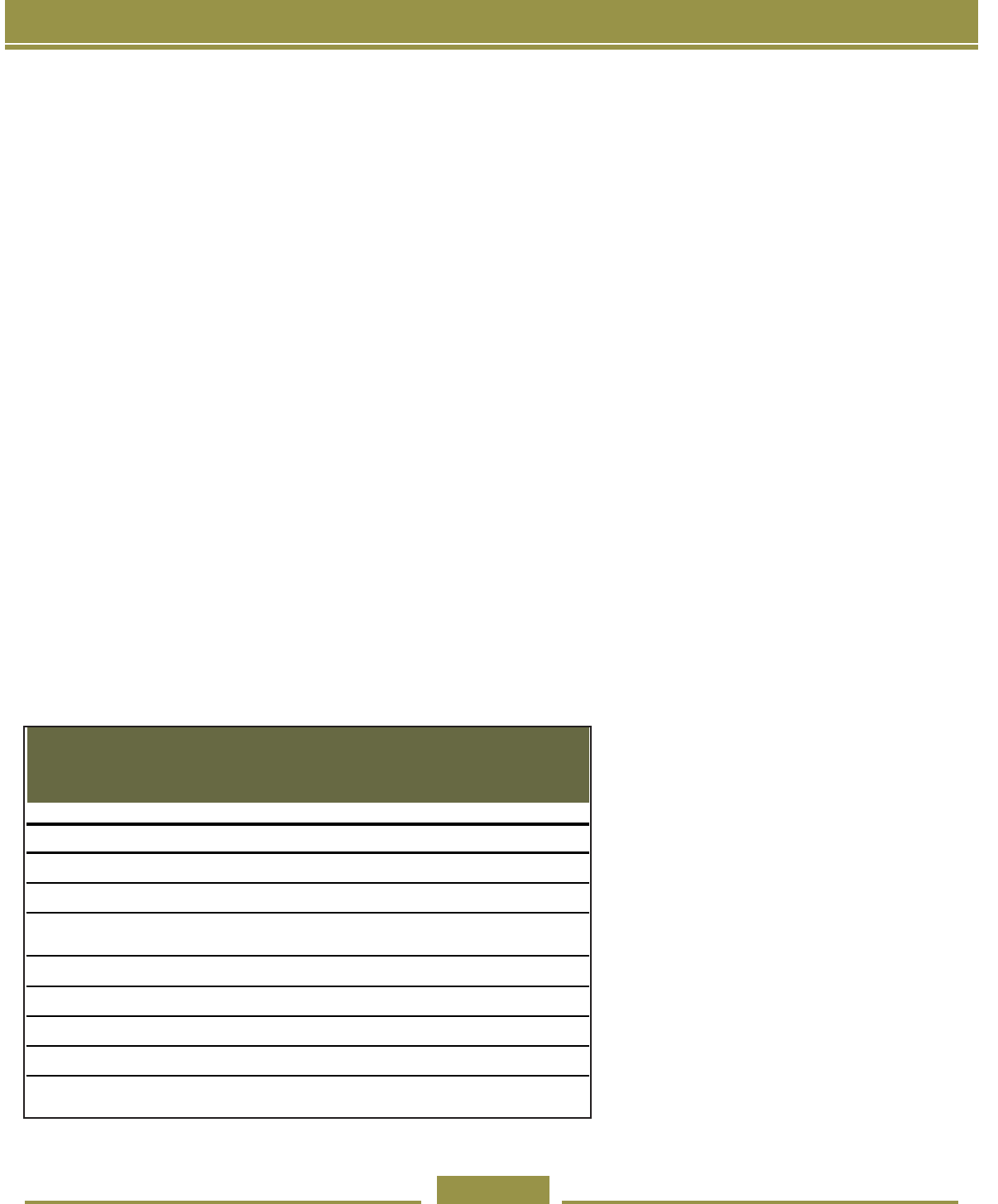

67.72

98.21

153.68

177.50

160.34

166.36

87.91

0

50

100

150

200

FY2004

FY2005

FY2006

FY2007

FY2008

FY2009

FY2010

Millions

Corporation License Tax

Collections

FY 2004 $67,722,940

FY 2005 $98,213,717

FY 2006 $153,675,069

FY 2007 $177,503,707

FY 2008 $160,341,787

FY 2009 $166,357,514

FY 2010 $87,906,411

Corporation License Tax Collections

The table to the left and graph above show total corpo-

rate license tax collections for scal years 2004 through

2010. As a rule, corporate income tax collections in

Montana follow the general national economy. Total col-

lections in FY 2004 (which started on July 1, 2003) were

$67.7 million, increasing to $177.5 million in FY 2007

and declining to $87.9 million in FY 2010. Corporate

license taxes are deposited in the state general fund.

The table below provides a breakdown of revenues for

the last ve years by how they are collected and shows

refunds.

As can be seen from the table, estimated payments is

the largest source of corporate tax collections followed

by payments with returns. Average revenue over the

ve years was $39.556 million for payments with returns

and $112.215 million for estimated payments. Audit col-

lections have ranged from $10.8 million to $31.0 million

and averaged $20.2 million per year over the ve years.

Overview of Corporate License Tax

Payments

with

Returns

Estimated

Payments

Audit

Collections

1

Refunds

Total

Collections

FY 2006 44,163,925 109,666,297 10,830,003 (10,985,156) $153,675,069

FY 2007 31,625,075 141,658,487 26,814,040 (22,593,895) $177,503,707

FY 2008 39,473,130 127,433,439 16,874,522 (23,439,304) $160,341,787

FY 2009 45,608,755 109,585,667 31,041,454 (19,881,362) $166,354,514

FY 2010 36,909,143 72,732,614 15,380,337 (37,121,182) $87,900,911

Average 39,556,005 112,215,301 20,188,071 (22,804,180) 149,155,198

1 Includes penalties and interest as well as taxes collected

Corporation License Tax Collections, Refunds and Fees

revenue.mt.gov

66

Refunds averaged $22.8 million per year, but were as

low as $11.0 million in FY 2006, and as high as $37.1

million in FY 2010. Total collections averaged $149.155

million per year, but ranged between $87.9 million in FY

2010 up to $177.5 million in FY 2007.

Organizations exempt from the tax include corporations

or associations organized and operated exclusively for

religious, charitable, scientic, or educational purposes,

and whose income does not benet any stockholder or

individual. Other entities exempt from corporate license

tax include labor, agricultural or horticultural organiza-

tions; civic organizations operated exclusively for the

promotion of social welfare; clubs or corporations orga-

nized and operated exclusively for pleasure; recreation

or other nonprot purposes and who do not have any

income that benets any private stockholder or member;

and similar non-prot organizations. Unrelated business

taxable income, as dened by federal law, of exempt

organizations which creates more than $100 of federal

tax liability is taxable as corporate income in the same

manner as other taxable corporate income. In order

to receive treatment as exempt from state corporation

taxes, the corporation must prove it is in compliance

with all statutory conditions (15-31-102, MCA and ARM

42.23.103).

Research and development (R&D) rms organized to

engage in business for the rst time in Montana are not

subject to the corporate license tax for the rst ve years

of operation. In order to receive this tax treatment the

rm must make an application to the Department of Rev-

enue and be approved as meeting legislative require-

ments (15-31-103, MCA).

Regular or C Corporations 14,173

S Corporations 25,603

Total Corporations 39,776

Corporations Paying $50 Minimum Tax * 9,578

Corporations Paying More Than $50 Minimum Tax 4,595

Total Regular Corporations 14,173

Returns Filed in Tax Year 2010

* Includes corporations filing a tax return, but claiming zero taxable

income

Only C corporations pay corporate license taxes. Cor-

porations that elect to le as a subchapter S corporation

for federal tax purposes are also required to le as a

subchapter S corporation for Montana corporate license

tax purposes. Despite the ling requirement, subchapter

S corporations do not pay Montana corporate license

taxes. Instead the owners or shareholders of the S cor-

poration are subject to income tax on income channeled

through the S corporation to the owner or shareholder.

Then the owner/shareholder reports any taxable income

on their individual income tax form. S corporations are

discussed in the section on pass-through entities follow-

ing this section.

The table on the following page provides a distribution

by Montana tax liability of the 14,173 corporate returns

with a Montana tax liability led in scal year 2010.

Altogether the top 100 returns constituted nearly 80%

of total tax liability for the group and the top 500 returns

accounted for over 90% of total Montana tax liability for

the group. The other 13,675 returns accounted for only

8.0% of the total Montana tax liability.

The starting point for calculating Montana corporation

license tax is the corporation’s federal taxable income.

In order to determine net income taxable by Montana,

certain adjustments to federal taxable income must be

made. For example, municipal bond interest is taxable

and must be added to income. Montana also allows cer-

tain reductions to income, such as a portion of the cost

of energy conservation investments made in a building

used for the corporation’s business. Then after addi-

tions and reductions, income is apportioned to Montana

to produce Montana taxable income.

If the corporation conducts business that is taxable only

in Montana, then all of the net income from that busi-

ness is Montana taxable income. The tax is levied at

a rate of 6.75% on net income earned in Montana.

Multi-state corporations conducting business that is

taxable both in and outside the state are required to

apportion income to Montana based on an equally

weighted, three-factor apportionment formula.

Sales, property and payroll comprise the three fac-

tors used in the apportionment formula. The payroll

factor is the ratio of payroll paid in compensation

attributable to the production of business income

during the tax period in Montana to all payroll paid.

Similarly, the property factor is based on the ratio

of Montana property to all property and the sales

factor is based on the ratio of Montana sales to all

Overview of Corporate License Tax

revenue.mt.gov

67

Cumulative

Percent Percent of

Tax of Total Total

Regular Corporation Returns Number Liability Liability Liability

Top 100 returns 100 $91,509,931 77% 77%

Second 100 returns 100 8,794,798 7% 84%

Third 100 returns 100 4,428,006 4% 88%

Fourth 100 returns 100 2,694,906 2% 90%

Fifth 100 returns 100 1,741,511 1% 92%

All other returns 13,673 9,792,779 8% 100%

Total 14,173 $118,961,931 100% n/a

Corporate Returns Filed for Tax Year 2010

Distribution of Montana Tax Liability

Percent Cumulative

Montana Tax of Total Percent of Total

Regular Corporation Returns Number Liability Liability Liability

Top 100 returns 100 95,393,646$ 68.9% 68.9%

Second 100 returns 100 12,810,607 9.3% 78.2%

Third 100 returns 100 6,801,700 4.9% 83.1%

Fourth 100 returns 100 4,266,700 3.1% 86.2%

Fifth 100 returns 100 2,899,356 2.1% 88.3%

All other returns 13,853 16,225,449 11.7% 100.0%

Total 14,353 138,397,458$ 100.0% n/a

Regular Corporation Returns Filed in Fiscal Year 2008

Distribution of Montana Tax Liability

sales. The tax is normally levied at a rate of 6.75% on

net income apportioned to Montana, with exceptions

explained below.

Following is an example showing how a multi-state cor-

poration doing business in Montana would calculate its

Montana source income. The corporation, Company A,

has $1 million in payroll in Montana out of total payroll of

$10 million; $2 million of property in Montana out of total

property of $125 million; and sales in Montana of $4 mil-

lion out of total sales of $100 million during the tax year.

These facts result in an apportionment factor of

0.052. If this corporation had total taxable income

of $10,000,000, then its Montana taxable income is

$520,000 ($10 million times 0.052), and its state income

tax is $35,100 (before credits).

Montana is a worldwide, combined unitary state. A

business is unitary when the operations of that busi-

ness within the state depend on or contribute to the

operations of that business outside the state. However,

in Montana, corporations can elect to have only their

United States income included in the apportionment

process. Corporations taking this election, called

a “water’s edge” election, pay the tax at a rate of

7% instead of 6.75%. Multinational unitary cor-

porations wishing to le under the water’s edge

method are required to le a written election

within the rst 90 days of the tax period for which

the election is to become effective. The Depart-

ment of Revenue must approve the election

before the corporation uses it and the election is

binding for three consecutive taxable periods.

Corporations whose only activity in Montana

consists of making sales, and who do not own

or rent real estate or tangible personal property,

and whose annual gross volume of sales made

in Montana does not exceed $100,000 may elect

to pay an alternative tax equal to ½ of 1% of

gross sales.

There is a minimum tax of $50 for any corpora-

tion doing business in the state. The table on

returns led in Fiscal Year 2010 earlier in this

section shows that for those returns led in FY

2010 by corporations, the minimum tax was paid

on 9,578 returns, or almost 68%. If the corpora-

Overview of Corporate License Tax

Company A has:

Payroll in Montana Total Payroll Payroll Factor

$1,000,000 ÷ $10,000,000 = 0.1

Property in Montana Total Property Property Factor

$2,000,000 ÷ $125,000,000 = 0.016

Sales in Montana Total Sales Sales Factor

$4,000,000 ÷

$100,000,000 = 0.04

Equally weighted factor Add factors together 0.156

then divide by 3

÷ 3

which equals 0.052

So the apportionment factor is: 0.052

Example of apportionment factor calculation for a multi-state

corporation

revenue.mt.gov

68

tion has no property, sales, or payroll in the state during

the tax period, it is exempt from the minimum tax.

In Montana, net operating losses (NOL) of the corpora-

tion may be carried back for a period of three years and

used to reduce prior year income, and may be carried

forward for a period of seven years to reduce income

in those future years. Until recently, federal tax rules

allowed NOLs to be carried back two years and then

forward for up to 20 years (corporations can also vol-

untarily elect to just carry forward losses for up to 20

years). However, in November 2009, H.R. 3548, the

“Worker, Homeownership, and Business Assistance Act

of 2009”, become law. This act increases the allowable

carryback period for applicable net operating losses at

the federal level for most corporations from 2 years to 3,

4, or 5 years. An applicable NOL means the taxpayer’s

NOL for any tax year ending after Dec. 31, 2007, and

beginning before Jan. 1, 2010.

The table below provides a comparison of Montana

treatment of net operating loss deductions versus other

states in the region. Like Montana, Utah provides a

three year carryback of net operating losses, but has a

limit of $1 million. Utah allows losses to be carried for-

ward up to 15 years versus 7 years for Montana. Idaho

allows losses to be carried back against income for up to

2 years, but limits carryback losses to $100,000; Idaho

allows carryforward of losses for up to 20 years. Ari-

zona, Colorado, North Dakota and Oregon allow carry-

State Carryback/Carryforward periods

Arizona 0 back, 5 forward

Colorado 0 back, 20 forward

Idaho

Montana 3 back, 7 forward

North Dakota 0 back, 20 forward

Oregon 0 back, 15 forward

Utah 3 back (limited to $1 million), 15 forward

Nevada, Washington and Wyoming do not have a corporate income tax.

2 back ($100,000 limit), 20 forward,

or 0 back, 20 forward

Comparison with Other States in Region with a Corporate

Income Tax

Net Operating Loss Deductions

forward of losses for 5 years, 20 years, 20 years and 15

years, respectively, and do not allow carryback of loss

deductions.

The table on the next page provides a comparison of all

states with a corporate income tax and what they allow

in terms of carrying net operating losses backward and

forward. All states with a corporate income tax allow

some form of carryforward of losses, from ve to twenty

years, but many do not allow carryback of net operating

losses.

Overview of Corporate License Tax

revenue.mt.gov

69

5 years

forward

7 years

forward

10 years

forward

12 years

forward

15 years

forward

20 years

forward

Arizona

New Jersey

Kansas

Illinois

Alabama California

Arkansas Michigan

Minnesota

Colorado

Massachusetts

New Hampshire 3/

North Carolina

Connecticut

Nebraska

Vermont Oregon

District of Columbia

New Mexico

Tennessee

Florida

Rhode Island

Wisconsin

Iowa

Texas Kentucky

Maine

North Dakota

Ohio

Pennsylvania 5/

South Carolina

Alaska

Delaware 1/

Georgia

Hawaii

Idaho 2/

Indiana

Maryland

Mississippi

Missouri

New York 4/

Virginia

West Virginia 7/

Montana

Louisiana

Utah 6/

Source: 2010 State Tax Handbook , CCH, 2009.

1/ Delaware has a $30,000 limits on carrybacks.

2/ Idaho has a $100,000 limit on carrybacks.

3/ New Hampshire limits carryforward of losses to $1 million.

4/ New York has a limit of the first $10,000 of loss on carrybacks.

6/ Utah has a $1 million limit on carrybacks.

7/ West Virginia limits carrybacks to $300,000.

States with Corporate Taxes

Allowed Carrybacks and Carryforward Periods for Net Operating Losses

0 years

back

2 years

back

Allowed years of carryforward

Allowed

years of

carryback

3 years

back

5

/ Pennsylvania has a limit of $3 million or 15% of taxable income for tax year 2009, and $3 million or 20% of taxable

income for tax year 2010 on carryforward.

Overview of Corporate License Tax

Thirty one states do not allow carryback of net operating

losses, but do allow carryforward of losses, from 5 years

up to 20 years. Twelve states allow the same carryfor-

ward and carryback periods as federal tax law has his-

torically allowed (2 back and 20 forward). Three states

- Montana, Utah and Louisiana – allow corporations with

net operating losses to carry back these losses against

the three prior years of income.

revenue.mt.gov

70

Credit

Number

of

Credits

Total Credit

Amounts

Number

of

Credits

Total Credit

Amounts

Contractors Gross Receipts Tax Credit 91 1,692,954 72 487,413

Charitable Endowment Credit 18 54,516 29 103,189

Montana Recycling Credit * 70,936 * 25,937

Credit for Increasing Research Activities 22 588,068 12 82,965

Credit for Contribution to MT University or Private College 31 6,714 19 3,636

Montana Capital Company Credit 0 0 0 0

Health Insurance for Uninsured Montanans Credit 86 65,632 61 43,400

Credit for Alternative Fuel Motor Vehicle Conversion 0 0 * 6,000

Alternative Energy Production Credit * 15,094 * 50

Dependent Care Assistance Credit 0 0 0 0

New/Expanded Industry Credit 0 0 0 0

Historical Building Credit 0 0 0 0

Infrastructure Users Fee Credit * 541,522 * 431,692

Mineral Exploration Incentive Credit * 1,361 * 25

Interest Differential Credit 0 0 0 0

Film Production Credit * 16,583 0 0

Biodiesel Blending and Storage Credit 0 0 0 0

Oilseed Crushing and Biodiesel Production Credit 0 0 0 0

Geothermal System Credit 0 0 0 0

Insure Montana Credit 164 1,009,331 155 880,874

Empowerment Zone Credit 0 0 0 0

Total Credits 427 4,062,711 358 2,065,181

Some of the above credits are claimed on returns that have not been audited yet. The amount of credit claimed

may change once these returns are audited. In addition, some of the above numbers represent a carryback of some

credits claimed on amended returns received during the fiscal year.

* Indicates that credits were claimed on fewer than 10 returns.

Montana Corporation Tax Credits

--- Fiscal Year 2009 ---

--- Fiscal Year 2010 ---

Overview of Corporate License Tax

Credits

As with individual income tax, corporations with expen-

ditures that qualify can claim tax credits. The following

table shows what credits have been claimed in the last

two scal years and the number of corporations claiming

those credits.

revenue.mt.gov

71

Estimated Payments

Companies with a tax liability of $5,000 or more have to

make quarterly estimated payments. Tax returns for tax-

payers using a calendar year as their scal year are due

May 15

th

. Tax returns for taxpayers using another period

as their scal year are due the 15

th

day of the fth month

after close of the taxable year. Taxpayers must use

the same tax period they used on the federal tax return.

Automatic extensions are allowed for up to six months

following the prescribed ling date.

Penalties and Interest

Corporations who do not pay a tax when due may be

assessed a late payment penalty of 1.2% per month on

the unpaid tax, up to a maximum penalty of 12% of the

tax due. Interest on unpaid tax accrues at a rate of 12%

per year, or at 1% per month or fraction of a month on

Estimated Payments, Penalties and Interest

revenue.mt.gov

72

the unpaid tax.

Comparison of Corporate Tax Rate with Other States

Forty-four states and the District of Columbia have a

tax on corporate income. The table to the left uses data

from the Federation of Tax Administrators (as of January

1, 2010) to show the maximum rates for states that have

a corporate tax. These go from 12% down to 4%.

A number of states have a graduated income tax which

is indicated by an asterisk next to the state.

Nevada, Washington and Wyoming do not have state in-

come corporation taxes. Texas imposes a franchise tax

based on gross revenues and South Dakota has a tax

on nancial institutions only. Ohio has adopted a com-

mercial activity tax which is a tax on gross receipts.

The table below provides a comparison of Montana’s

tax rate with the maximum tax rate for other states in

the region that have a corporate income tax. As noted

before, Nevada, Washington and Wyoming do not have

corporate income taxes.

Rank State

Maximum

Tax Rate

1 Oregon 7.90%

2 Idaho 7.60%

3 Arizona 6.97%

4 Montana 6.75%

5 North Dakota * 6.40%

6 Utah 5.00%

7 Nevada 0.00%

8 Washington 0.00%

9 Wyoming 0.00%

Maximum Corporate Tax Rate

Regional Ranking - Tax Year

2010

Comparison of State Corporate Tax Rates

Rank State

Maximum

Tax Rate

1 Iowa * 12.00%

2 Pennsylvania 9.99%

3 District of Columbia 9.975%

4 Minnesota 9.80%

5 Alaska * 9.40%

6 New Jersey 9.00%

6 Rhode Island 9.00%

8 Maine * 8.93%

9 California 8.84%

10 Massachusetts 8.75%

11 Delaware 8.70%

12 Indiana 8.50%

12 New Hampshire 8.50%

12 West Virginia 8.50%

12 Vermont * 8.50%

16 Maryland 8.25%

17 Louisiana * 8.00%

18 Wisconsin 7.90%

18 Oregon 7.90%

20 Nebraska * 7.81%

21 Idaho 7.60%

21 New Mexico * 7.60%

23 Connecticut 7.50%

24 Illinois 7.30%

25 New York 7.10%

26 Arizona 6.968%

27 North Carolina 6.90%

28

Montana 6.75%

29 Alabama 6.50%

29 Arkansas * 6.50%

29 Tennessee 6.50%

32 North Dakota * 6.40%

32 Hawaii * 6.40%

34 Missouri 6.25%

35 Kentucky * 6.00%

35 Georgia 6.00%

35 Oklahoma 6.00%

35 Virginia 6.00%

39 Florida 5.50%

40 Mississippi * 5.00%

40 South Carolina 5.00%

40 Utah 5.00%

43 Michigan 4.95%

44 Colorado 4.63%

45 Kansas 4.00%

As of Jan. 1, 2010. Federation of Tax Administrators

Maximum Corporate Tax Rate By State

From Highest to Lowest - Tax Year 2010

revenue.mt.gov

73

Business Structure and Taxation

States offer businesses a variety of options for legal

organization. Different business forms give the owners

different levels of liability for the business’ actions and

debts, different structures for making business deci-

sions, and different levels of access to capital markets.

For tax purposes, each of these business structures falls

into one of three categories: sole proprietor businesses,

pass-through entities, and C corporations.

Income from a sole-proprietor business is reported

on the owner’s tax return and is taxed as the owner’s

income. A pass-through entity les an informational

return showing its income and how the income is di-

vided between the owners. The owners are taxed on

their shares of the business’ income, whether or not the

income is distributed to them, but the business is not

taxed. Pass-through entities can be either S corpora-

tions or partnerships, and somewhat different accounting

procedures apply to how net income can be distributed

between owners. A C corporation les a return and is

taxed on its net income. The owners are taxed on divi-

dends the business pays them.

In many cases, a rm’s legal business structure de-

termines its tax treatment, but some rms can choose

between two or more options for tax treatment.

Pass-through entities include partnerships; S corpora-

tions; limited liability companies (LLCs); real estate

investment trusts (REITS); regulated investment compa-

nies (RICs), better known as mutual funds; and others.

Partnerships are an old and familiar business entity to

many, but S corporations are less so. The S corporation

rules were enacted in 1958 and permit a corporation

and its shareholders to elect to be taxed at one level.

However, S corporation status has limitations relative to

C corporations. S corporations can have no more than

100 shareholders, although family members are treated

as one shareholder. Only one class of stock is allowed,

and ownership is limited to U.S. taxpayers or entities.

The most common type of pass-through entity today

is the limited liability company, or LLC. The rst LLC

statute was enacted in Wyoming in 1977, and now all

states and the District of Columbia have LLC statutes.

For federal tax purposes, LLCs are generally treated

as partnerships, although LLCs can elect to be treated

as S corporations. A single member LLC can elect to

be treated as a sole proprietorship if the single member

is an individual; if the single member is a corporation,

then the LLC is treated as a division of a corporation. In

both cases, the LLC’s income is reported on the owner’s

return and the LLC does not le a separate return. In

Montana an entity generally has the same status as it

has for federal tax purposes. For example, if a business

led as an S corporation at the federal level, it must le

as an S corporation at the state level.

Partnerships and S corporations are “traditional” pass-

through entities. Their income, deductions, and credits

pass-through to the owners and the owners report the

items on their tax returns. Although they are traditional

corporations, REITs and RICs are effectively pass-

through entities because they are allowed a deduction

for dividends paid to shareholders. Therefore, usually

the REIT or RIC pays no tax and the shareholders are

only taxed on their REIT or RIC income. A limited liabil-

ity company has no independent tax status. Instead it is

taxed as either an S corporation, or a partnership or a C

corporation; if it has only one owner, the LLC’s existence

is disregarded for most tax purposes.

The following table shows characteristics of businesses

falling into each of the four business tax categories.

Overview of Pass-Through Entities

revenue.mt.gov

74

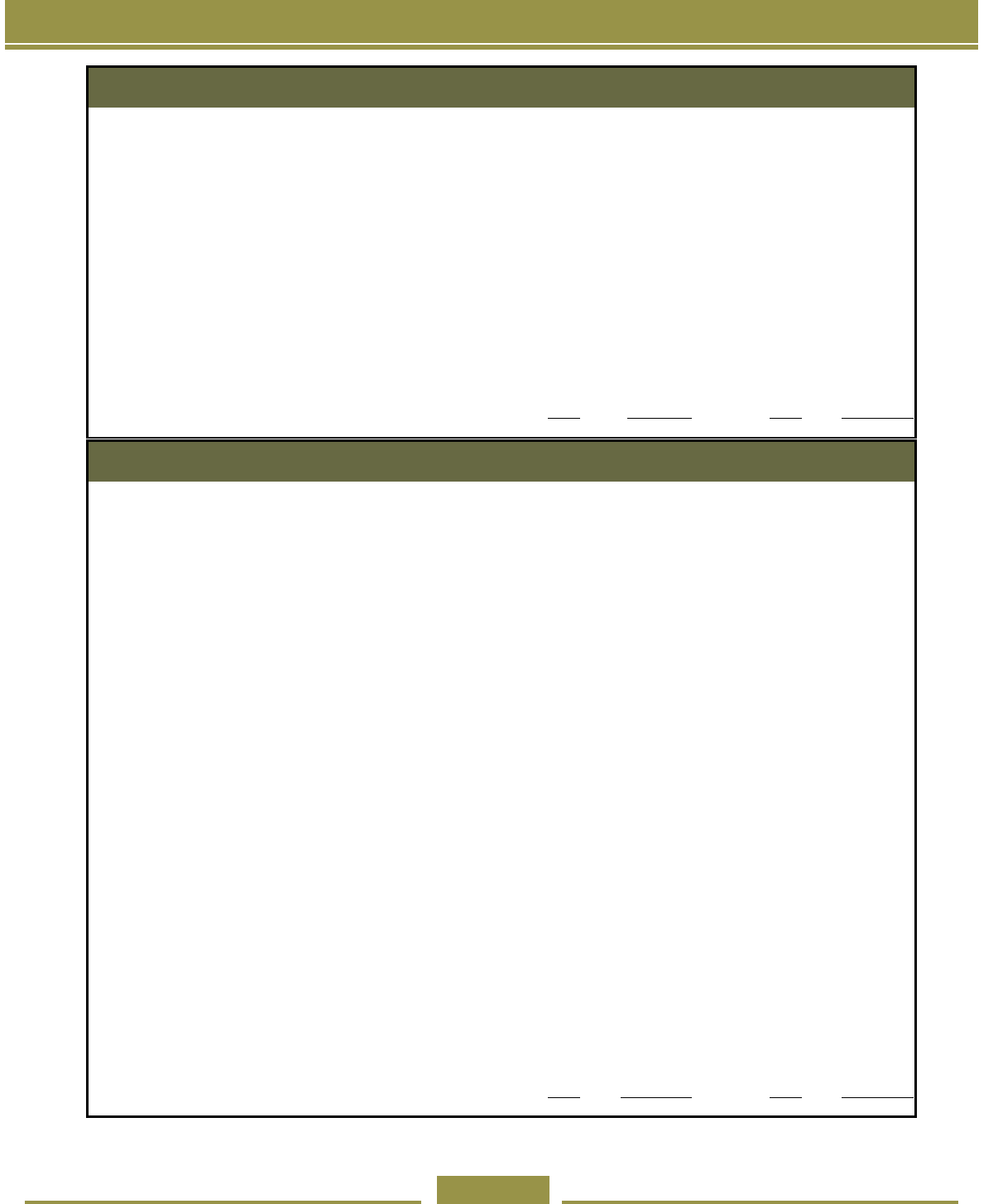

Overview of Pass-Through Entities

Individual

Pass-Through Entity

(S - Corporation or

Partnership)

C - Corporation Disregarded Entity

Legal

Business

Organization

Informal

Partnership, Limited

Liability Company (LLC),

Corporation, Limited

Partnership, etc.

Corporation Single Member LLC, etc.

May be

Owned By

One Individual or

Married Couple

Individuals or Other

Business Entities

Individuals or Other

Business Entities

Individuals or Other

Business Entities

Business

Income and

Owner's

Income

The business' net

income is all attributed to

the owner.

The business calculates

its net income, and this

income is attributed to

the owners.

The business calculates

its net income. Owners'

income is dividends

received.

The business' net

income is all attributed to

the owner.

Distribution of

Income to

Owners

The business' net

income is the owner's

income from the

business.

Distributions to owners

need not equal business'

current net income.

Business pays dividends

to shareholders.

Dividends need not

equal business' current

net income.

Distribution to owner

need not equal

business's current net

income.

Taxation

Owner reports income

from business as part of

income subject to

individual income tax

No tax at the entity level.

Owners responsible for

tax on income attributed

to them.

Business' net income

subject to corporation

license tax. Owners

taxed on dividends.

Entity is ignored.

Business' income is

taxed as owner's

income.

Reporting

The business' receipts

and costs are reported

on Schedule C of the

owner's federal tax

return (Schedule F for a

farm), and net income is

reported on Line 12 for

Business Income or

Loss (Line 18 for Farm

Income or Loss) of the

state return.

The business files

federal and state

information returns.

Federal return shows

receipts and costs and

both show income,

deductions, and credits

passed through to

owners. Owners report

their share of net

business income from

the pass-through as

business income

(Schedule E and Line 17

of the tax return for

individuals). If the

business receives

dividends, capital gains,

or other passive income,

owners report those

separately on the

appropriate return lines.

The business files

federal and state

corporate income tax

returns and a federal

information report, Form

1099-DIV, for each

owner who received at

least $10 of dividends.

Owners report dividends

received on their tax

returns (Line 9 of state

return for individuals).

Income is reported on

owner's return.

Business Structure and Taxation

revenue.mt.gov

75

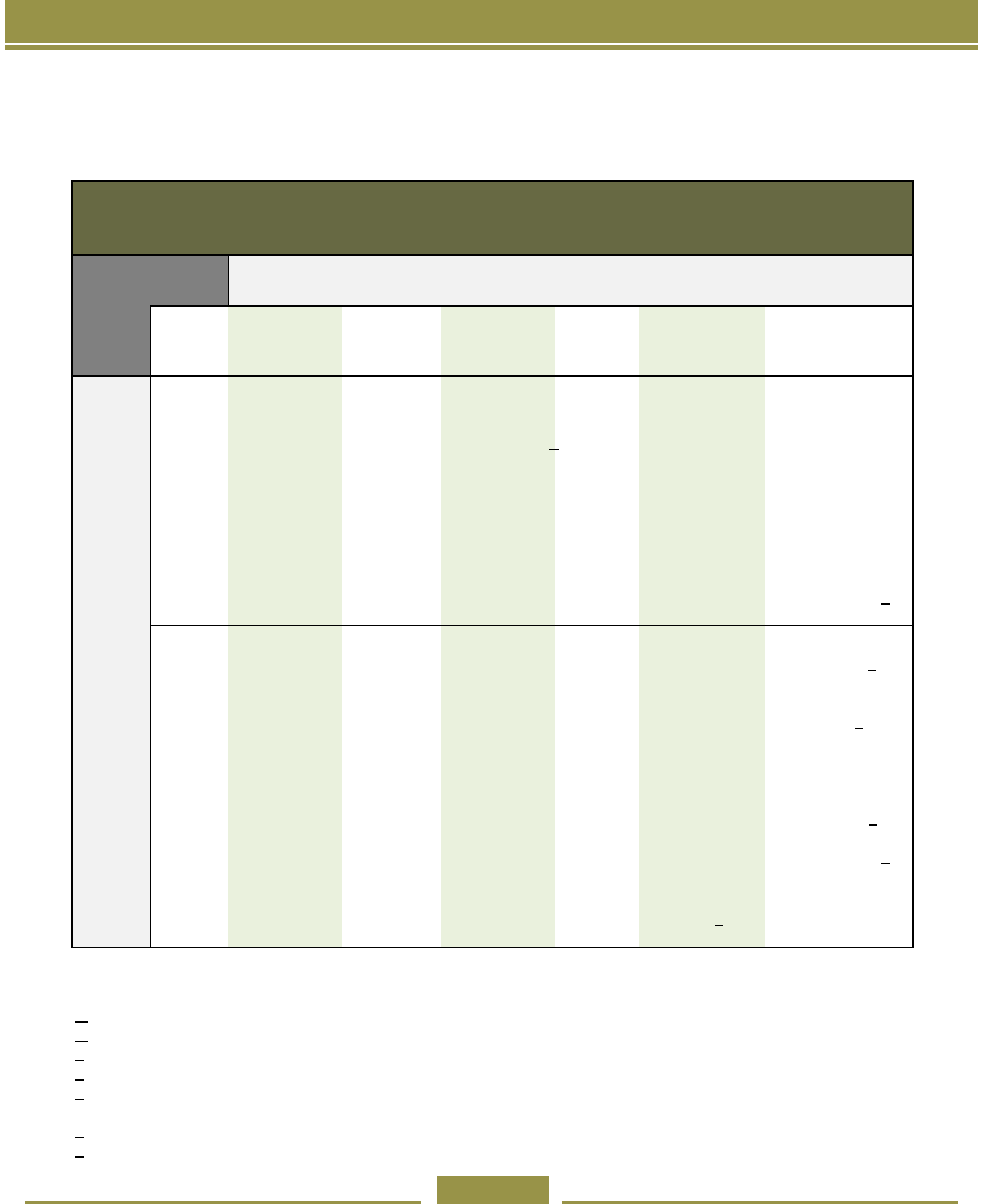

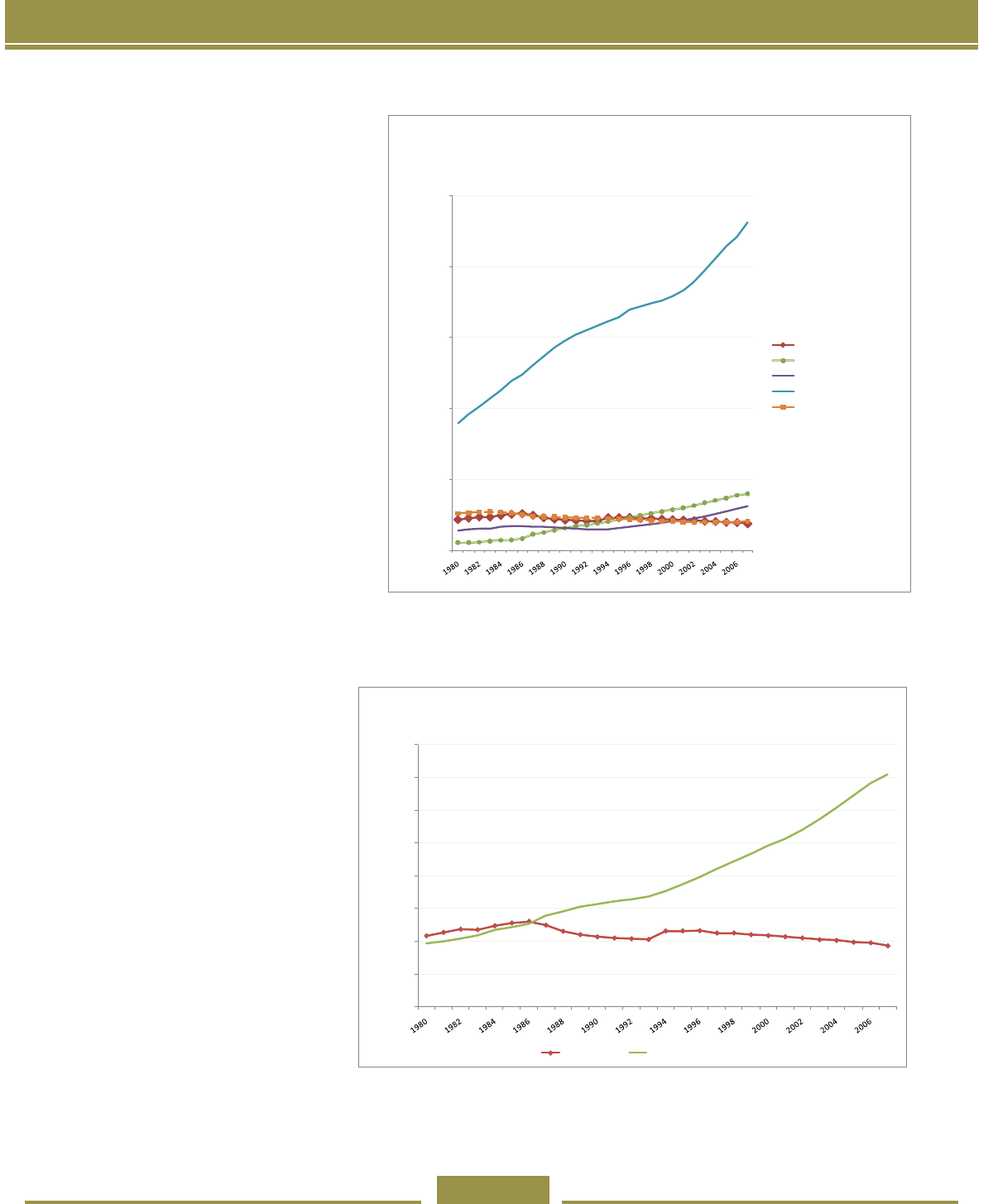

Growth of Pass-Through Entities

Increasingly, in Montana and nation-

wide, business and investment activities

are being conducted by pass-through

entities. The graph on the top right

shows the number of returns led with

the IRS by business types from 1980

through 2007. As can be seen from the

graph, non-farm sole proprietorships are

the most common type of business en-

tity in the U.S., based upon the number

of returns led. The number of non-farm

sole proprietorships has been grow-

ing steadily over the time period, going

from 9 million in 1980 up to 23 million in

2007, an average annual growth rate of

almost 3.6%. The number of S corpora-

tions has also grown very rapidly dur-

ing the same time – up from 545,000 in

1980 to almost 4 million in 2007, an an-

nual growth rate of 7.6%. Partnerships

grew more slowly – increasing from 1.4

million in 1980 to 3.1 million in 2007.

During the same period, both the num-

ber of corporation returns and farm re-

turns (based upon schedule F) declined,

with corporations going from 2.2 million

in 1980 to 1.9 million in 2007 and farms

(ling schedule F) going from 2.6

million in 1980 to 2.0 million in 2007.

However, it should be noted that

farms can also operate as partner-

ships or be incorporated as S or C

corporations. Although they are not

shown on the graph, the number of

REIT and RIC returns also grew over

this time period, going from 1,691

returns in 1980 to 13,724 returns in

2007.

The graph on the bottom left is

based upon the same data as in

the graph above, but compares

the growth in the number of pass-

through entities (partnerships and S

corporations) to that of C corpora-

tions.

Sole proprietorships, just as the

name suggests, are businesses with

a single owner and are a familiar

Growth of Pass-Through Entities

-

1,000,000

2,000,000

3,000,000

4,000,000

5,000,000

6,000,000

7,000,000

8,000,000

Number of C Corporation Returns Compared to the Sum of S

Corporation and Partnership Returns, 1980-2007

C corporations

Pass-through Entities

-

5,000,000

10,000,000

15,000,000

20,000,000

25,000,000

Number of Different Types of Business Returns

(IRS Statistics of Income)

C corporations

S corporations

Partnerships

Non-farm sole proprietorships

Farms (Schedule F)

revenue.mt.gov

76

sight on many main streets in Montana. The Depart-

ment of Commerce, in its December 2007 publication,

Economic and Demographic Analysis of Montana,

reports that over 60% of Montana businesses are sole

proprietorships without any employees. The owner of

a sole proprietorship will record his or her income on

the state individual income tax form, Form 2 on line 12,

as Business Income (or loss), and will attach a copy of

federal Schedule C (or C-EZ), which has been led with

the taxpayer’s federal tax return. If the business owner

has a farm or ranch operation that is operated as a sole

proprietorship, the taxpayer reports his or her income on

line 18 of the state individual income tax form (Farm In-

come or (loss)), and attaches a copy of federal Sched-

ule F, which has been led with the taxpayer’s federal

form.

One thing to note is that C corporations in Montana vary

greatly in size – there are large or very large businesses

that engage in operations across many states and even

countries, but there are also smaller rms that engage

in agricultural operations, main street businesses, or

regional operations. Some of these may have been

incorporated before S corporations were available or

well understood; others may have been incorporated as

C corporations in order to be better positioned to ac-

cess capital markets or otherwise need one or more of

the advantages that C corporation status provides. For

example, S corporation shareholders pay tax on the

entity’s income, whether or not distributed. C corpora-

tion shareholders pay tax only on dividends distributed

to them. It can be advantageous to a company that is

growing to retain its earnings inside the corporation;

however, for S corporation shareholders, this means

that they may be taxed on income, but are not actually

receiving any of that money.

Growth of Pass-Through Entities

revenue.mt.gov

77

Montana Multi-State Montana Multi-State

Returns 21,607 3,996 16,508 3,424

Income Items

Salaries and Other Fixed Payments to Owners $0.0 $0.0 $247.4 $26.3

Ordinary Business Income $1,066.5 $368.4 $549.1 $174.3

Rental Income

Real Estate $24.6 $5.4 -$105.5 -$1.1

Other -$5.8 $6.0 -$4.2 -$2.4

Interest $47.2 $13.0 $958.6 $31.0

Dividends $10.6 $4.5 $344.4 $8.6

Royalties $7.4 $8.1 $88.8 $19.9

Capital Gains $80.4 -$56.8 $447.2 $21.4

Gains from the Sale of Business Property $134.3 $376.4 $228.8 $108.0

Other Income $16.4

$1.6 -$83.0 $14.9

Total $1,381.6 $726.7 $2,671.6 $401.0

Montana Additions to Federal Income

Interest on Non-Montana Municipal Bonds $1.3 $2.4 $3.7 $0.4

State and Local Income Taxes $3.4 $12.2 $4.1 $0.5

Other $12.3

$1.5 $62.9 $12.1

Total $17.0 $16.1 $70.6 $13.0

Montana Subtractions from Federal Income

Interest on Federal Bonds $22.2 $0.4 $17.2 $0.3

Purchases of Recycled Materials $0.2 $0.0 $0.0 $0.1

Other $10.6

$14.4 $96.6 $14.9

Total $33.0 $14.8 $113.8 $15.3

Deductions

Expensing of Capital Purchases $162.9 $54.2 $455.3 $174.2

Contributions $20.4 $6.6 $20.4 $1.8

Intest on Funds Borrowed to Make Investments $5.9 $0.7 $391.5 $2.5

Other $9.7

$26.6 $913.2 $24.4

Total $198.8 $88.2 $1,780.4 $202.9

Total Net Montana Source Income $1,166.8 $639.9 $848.0 $195.7

S Corporations Partnerships

Montana-Source Income Passed Through To Owners, 2008

($ million)

Income, Deductions and Credits Reported on Mon-

tana Pass-Through Returns

Pass-through entities that are classied as S corpora-

tions and partnerships for tax purposes are required to

le information returns each year. These returns show

the total amounts various types of income, deductions,

and credits allocated to the owners and the amount

distributed to each owner. Pass-through entities that

operate in more than one state apportion part of their

income to Montana using the same apportionment

formula as corporations. The following table shows

Montana-source income allocated to owners on 2008

pass-through returns.

Pass-Through Entity Returns

revenue.mt.gov

78

Net income from the pass-through’s business operations

is usually allocated to the owners as ordinary busi-

ness income. Individual owners report this income on

Schedule E of their federal tax returns and then income

from Schedule E is reported on Line 17 of their Montana

Form 2. Income the pass-through receives from passive

investments or the sale of assets is allocated to the own-

ers as that type of income, and owners report it on the

corresponding line of their tax returns. For example, if a

pass-through receives $1,000 of interest and allocates it

equally to its ten owners, who are Montana individuals,

each owner should report the $100 of interest on Line 8a

of their Form 2.

Montana Multi-State Montana Multi-State

Dependent Care Credit $0 $0 $0 $0

College Contribution Credit $12,644 $955 $1,275 $609

Insurance for Uninsured Montanans Credit $250,574 $6,040 $30,553 $0

Credit for Investment in Recycling Equipment $340,158 $166,111 $79,117 $40,954

Alternative Energy Production Credit $0 $0 $0 *

Contractors' Gross Receipts Credit $17,334 $0 $18,510 $9,703

Alternative Fuel Credit $3,245 $0 $0 $0

Infrastructure Users Fee Credit $0 $0 $35,547 $0

Charitable Endowment Contribution Credit $49,443 $6,640 $15,298 $4,600

Historic Building Preservation Credit $0 $1,346 $0 $0

Increased Research Activity Credit $95,108 $97,501 $2,253 $6,828

Empowerment Zone Credit $0 $0 $0 $0

Film Production Credit $23,891 $12,062 $0 $14,328

Biodiesel Blending Credit $0 $0 $0 $0

Oilseed Crushing Credit $0 $0 $3,455 $0

Geothermal Heating System Credit $0 $0 $3,000 $0

Insure Montana Credit $1,280,450 $45,335 $231,824 $14,462

Temporary Emergency Lodging Credit $0

$0 $0 $0

Total $2,072,847 $335,990 $420,832 $91,484

Tax Credits Passed Through To Owners, 2008

S Corporations Partnerships

When a pass-through does something that is eligible for

a tax credit, the credit is usually allocated to the owners

who claim their share of the credit on their tax returns.

Owners may or may not be able to claim the credit. For

example, some credits can only be claimed by individu-

als, and some owners may have no taxable income to

claim a credit against.

The following table shows credits reported on pass-

through returns for 2008 as passed through to owners.

Credits actually claimed by owners are included in the

credits claimed for individual income tax and corpora-

Pass-Through Entity Returns

revenue.mt.gov

79

tion license tax.The table below shows the numbers of

reported owners who are individuals and business enti-

ties and who are located in Montana or in other states.

It also shows the total income allocated to each group of

owners.

Most of the owners of pass-through entities doing busi-

ness only in Montana are Montana individuals. Most

of the owners of multi-state pass-throughs doing busi-

ness in Montana are non-Montana individuals, but about

one-third of the partners in multi-state partnerships are

non-Montana business entities.

Owners of pass-through entities taxed as partnerships

may be either individuals or business entities. While

Entities % Entities %

1 11,358 45.9% 153 0.8%

2 to 3 10,880 43.9% 13,523 70.5%

4 to 8 2,033 8.2% 4,145 21.6%

9 to 20 359 1.5% 852 4.4%

Over 20 128

0.5% 504 2.6%

Total 24,758 19,177

Pass-Through Entities - Number of Owners

S Corporations Partnerships

Number of Reported

Owners

shares of S corporations can only be owned by individu-

als, some types of pass-through entities that can be

owned by other business entities can elect to be treated

as S corporations for tax purposes.

Most pass-through entities have a small number of own-

ers. As the following table shows, more than 90% of

pass-through entities have eight or fewer owners.

About four-fths of entities with more than 20 owners are

partnerships. S corporations are limited to 100 share-

holders, while there are types of partnerships with one

active partner who runs the business and many partners

who are passive investors.

Pass-Through Entity Returns

Type of Owner Owners Income Owners Income Owners Income Owners Income

Resident Individuals 34,875 $872.5 1,454 $238.5 34,977 $335.1 1,366 $28.6

Non-Resident Individuals 3,884 $51.8 12,468 $421.4 11,785 -$67.5 24,810 -$32.2

Montana Business Entities 405 $22.0 23 $21.7 4,094 $183.4 247 $39.0

Non-Montana Business Entities 248

$128.2 1,479 $16.7 4,482 -$109.7 16,670 $80.3

Total 39,412 $1,074.5 15,424 $698.3 55,338 $341.3 43,093 $115.7

Income by Type of Owner 2008

($ million)

Partnerships

S Corporations

Montana

Multi-State

Montana

Multi-State

revenue.mt.gov

80

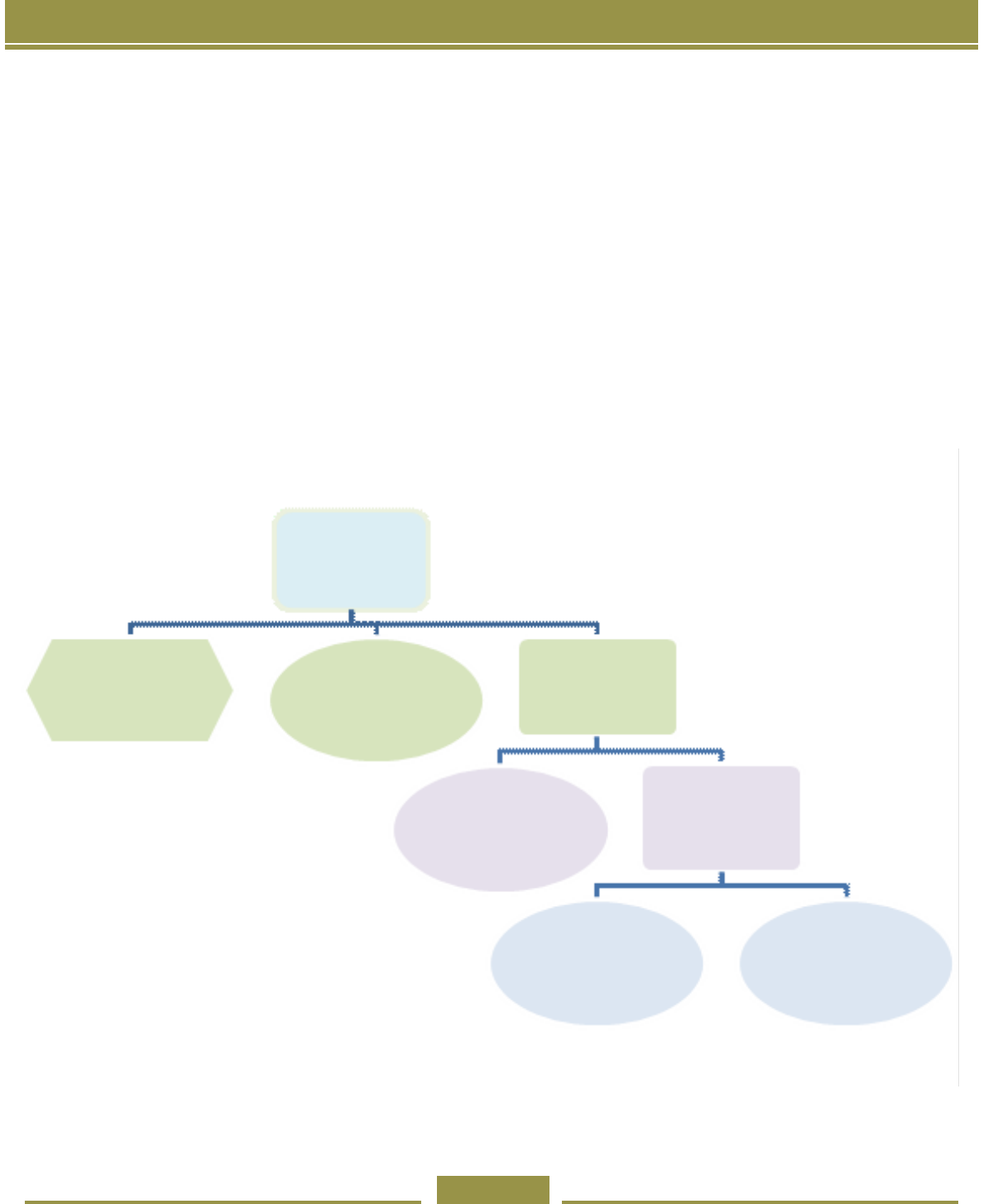

Tiered Ownership and Tax Administration

A pass-through entity is not itself taxed. Instead, its

income and expenses are reported in the tax returns of

the owners. These owners can be corporations, individ-

uals, other pass-through entities, or a mix of all of them.

When pass-through entities are owned by other pass-

through entities, a “tiered” business structure is created.

Tiered structures add complexity to tax administra-

tion because the “taxpayer” may be quite remote from

the entity doing business in the state. Because pass-

through entities can have either corporate, individual

and/or another pass-through entity as a partner, owner

or shareholder, they represent a challenge for tax ad-

ministration. The following diagram shows how complex

even a comparatively small set of ownership/partnership

Tax Administration of Pass-Through Entities

Tier 2 - Individual owner

receives $200 in income

from Tier 1 LLC

Tier 1 - LLC with

$1,000 in income

to be distributed to

owners

Tier 2 - Corporation

owner receives $100 in

income from Tier 1 LLC

Tier 2 - Individual owner

receives $200 in income

from Tier 1 LLC

Tier 2 - Limited

partnership receives

$700 in income from

Tier 1 LLC

Tier 3 - S corporations

receives $480 in

income from Tier 2

limited partnership

Tier 3 - Individual

owner receives $220 in

income from the Tier 2

partnership

Tier 4 - Individual owner

receives $240 in income

from Tier 3 S corporation

Tier 4 - Individual owner

receives $240 in income

from Tier 3 S corporation

Sources:

Joint Committee on Taxation, Tax Reform: Selected Federal Tax Issues Relating to Small Business and

Choice of Entity (JCX-48-08), June 4, 2008.

Internal Revenue Service, Statistics of Income.

relationships can become.

A pass-through entity with Montana source income must

le an informational return. If this entity has a partner,

shareholder, member or other owner who is a non-

resident individual or a foreign C corporation, the pass-

through entity is also required to:

(1) le with the state an agreement with the in

dividual nonresident to timely le a Montana

return, pay taxes and be subject to personal ju

risdiction of the state with respect to the income

from the pass-through, or

(2) le a composite return, or

(3) remit tax on their shareholders behalf.

If there is a second tier pass-through owner, either a

composite return has to be led or withholding (un-

less that second tier pass-through proves that all of its

shareholders are accounted for on Montana returns. If

an agreement is not met as led, the pass-through entity

must in all subsequent tax years withhold the appropri-

ate amount and remit the tax payment directly to the

state (15-31-1113, MCA).